COVID Continues to Throw Curveballs for China’s Ports

As has become clear, the endpoint of COVID-19—if it ever comes—won’t be as plainly defined as when it took off in the first quarter of 2020. Here we are now, two years later, and though things seem currently under control in the United States and Europe (though the Omicron subvariant BA.2 may be changing that), the impact of the pandemic is still coursing around the world.

And one of the current hotspots is back where it all started, China. The current situation in Shanghai, home to the world’s largest container port, is not great. Located a little over 800 kilometers from Wuhan, where COVID was discovered, China’s second-largest city (and the nation’s financial capital) has been struggling with its “zero COVID” policy in recent weeks. The city has seen food riots and there is a strong undercurrent of unrest developing.

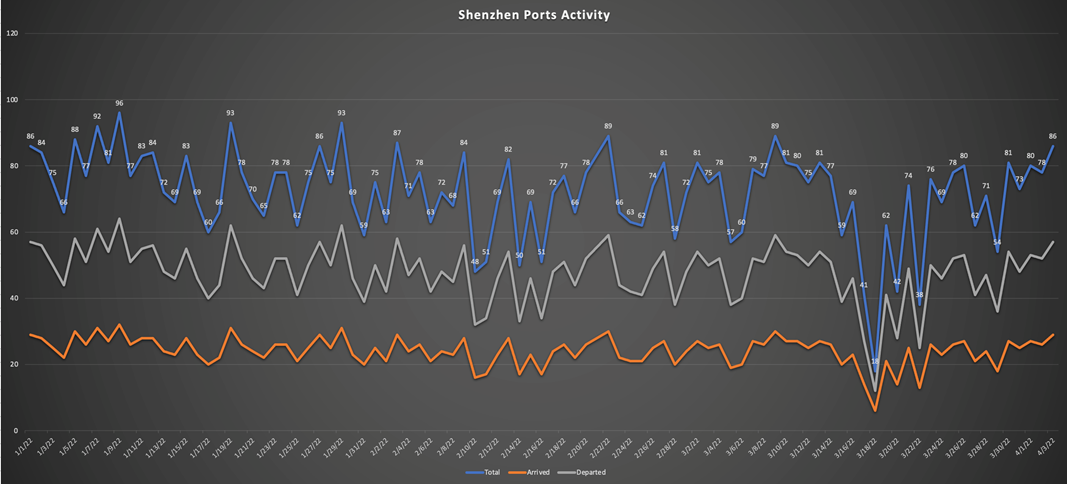

This comes on the heels of several other Chinese cities being put on lockdown. These measures have not only stressed residents but also, in some cases, shut down operations in major ports like Ningbo, Tianjin, and Yantian (which serves the tech-center Shenzhen). The big drop in activity at Shenzhen ports in early March can clearly be seen in this chart:

Data Source: Spire Maritime

The result of the current COVID-19 flare-up in China is an ongoing and deepening backlog at its ports. This is yet another jolt to the global supply chain at a time of inflationary stress, with the Russian invasion of Ukraine acting as yet another accelerant.

It’s Been a Long, Strange Supply Chain Trip

The last couple of years have been a slog. Though nothing compares to what healthcare staff endured, the shipping industry has had its fair share of headaches. The initial outbreak saw a frenzy of lockdowns around the world that threw the world economy into chaos. But then demand for manufactured goods actually surged because so many people were stuck at home and unable to spend their money on in-person activities. So, not only did ports and shipping companies have to deal with frightening pre-vaccine COVID-19 risks but also a quickly developing expansion of cargo.

By the time the post-pandemic economic uptick—dare we call it a boom—got rolling in 2021, the shipping industry was behind the 8-ball, especially on the west coast of the United States and in Europe. Between the global balance of 20-foot equivalent unit (TEU) containers getting way out of alignment and backlogs at ports (especially the Port of Los Angeles) becoming a stubborn issue, challenges were already significant entering 2022.

And then Omicron started to take off in China. Several factors are now in play, including the fact that previous Chinese lockdowns were successful in preventing COVID outbreaks that the level of natural immunity in China is not as high as in places that got hit harder. Another factor is the waning effectiveness of Chinese vaccines. Although upwards of 80% of Chinese citizens have been vaccinated, the Chinese-developed CoronaVac and Sinopharm shots appear to be not quite as potent and long-lasting as the mRNA vaccines developed in the West. The current outbreak is the worst China has seen.

This is why much of Shanghai has been in hard lockdown since early April, which has wreaked havoc with the local supply chain—including the delivery of food. Food scarcity is a cultural touchstone that informs many of the nation’s political norms. Twentieth-century Chinese history is littered with a series of famines that each killed millions. The cultural resonance of food availability in China cannot be overstated. This powerful cultural force is now interacting with the current Chinese government’s ongoing determination to not let COVID get out of hand. The measures that officials are taking—as caught between the proverbial rock and a hard place—has taken its toll on Shanghai’s port.

Supply Chain Issues Have Now Moved East

This is why angst about the global supply chain is no longer focused on the West but rather on developments inside China, which run the gamut from factory shutdowns to closed ports.

“China’s strict COVID-control policy could result in renewed supply-chain disruptions in the U.S. as shuttered factories in the Asian nation cause orders to back up, just as America’s busiest ports are beginning to process some of the pandemic backlog,” reported Bloomberg on March 15, before the current issues in Shanghai took hold. “But the effects of lockdowns in southern Chinese megacity Shenzhen—home to the nation’s most-important port after Shanghai—will ripple through to the Los Angeles-area sea-cargo hubs, the U.S.’s busiest container gateway, according to Noel Hacegaba, deputy executive director of the Port of Long Beach.”

A month later, things were getting grimmer according to the Reuters: “But the number of container vessels waiting off Shanghai—the world’s busiest container port—and nearby Zhoushan has more than doubled since the start of April to 118, nearly three times the number a year ago, Refinitiv data showed. Danish shipper Maersk on Monday recommended to clients that they divert from congested Shanghai port to other Chinese destinations.”

The implications for the global economy are huge, especially since the Russian invasion of Ukraine has already led to disruptions in products as wide-ranging as wheat, fertilizer, natural gas, and rail links between China and Europe that traverse Russia. The fact that Ukraine is an important supplier of neon, a critical raw material in semiconductor production, is especially important given the already long-standing backlog in computer chip production.

“With U.S. and NATO officials warning that the fighting in Ukraine could continue for months or even years, a greater economic toll looms. On Tuesday, the World Trade Organization slashed this year’s growth forecast to 2.8 percent from 4.1 percent before the war, saying the conflict had inflicted ‘a severe blow’ on the world economy,” reported The Washington Post on April 13. “Gregory Daco, chief economist for Ernst & Young, said a lengthy war—and a further increase of allied sanctions on Russia—could strip up to two percentage points off global growth. Wall Street economists expect the global economy to expand by 3.5 percent this year, according to an April survey by Bloomberg, down from 4 percent in March.”

Basically, it’s hard to imagine current events in China coming at a worse time.

The year began with the Port of Ningbo, China’s third busiest, significantly impacted by COVID protocols and resulting backlogs. Soon thereafter, the Port of Tianjin (the seventh busiest in the country and northern China’s largest) saw similar issues when COVID hit the area. At the time the severe lockdown measures were questioned due to the significant impact they were having on the economy, but COVID case counts have exploded since these early outbreaks. China is now averaging over 17 new cases per million daily, by far the highest rate since the pandemic’s onset, which is a profound rise from the 0.17 rate on the first day of 2022.

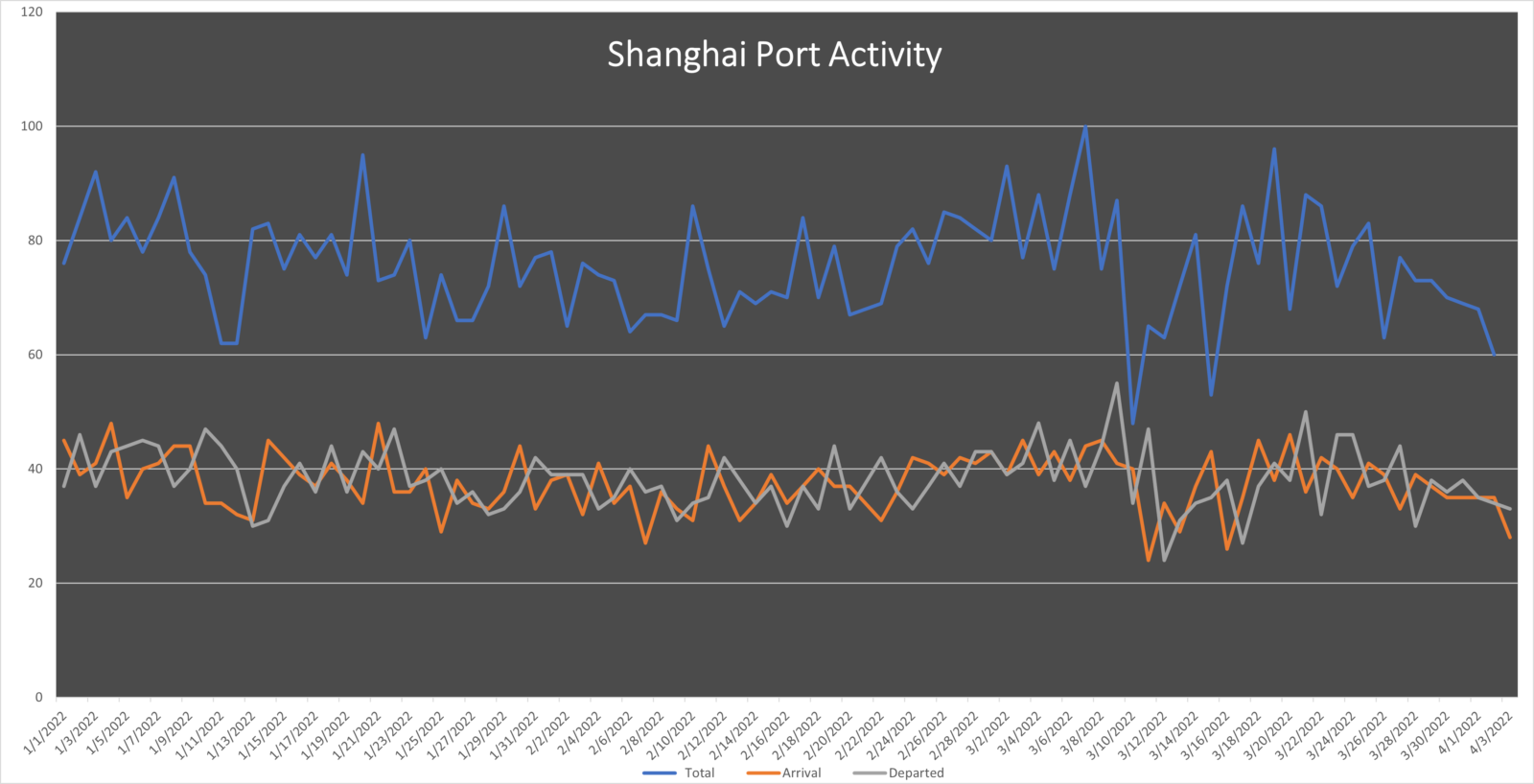

This rolling “lights out” situation has now reached the nation’s two largest ports, Shanghai and Shenzhen. The current drop-off of both arrivals and departures at the world’s largest container port can be clearly seen:

Data Source: Spire Maritime

A Mess That Won’t Get Cleaned Up for Awhile

The current situation represents successive disruptive waves hitting China. Hard lockdowns not only temporarily shutter factories and throw off delivery schedules to such an extent that domestic transportation concerns are pushed into crisis mode. They can also halt port operations when workers are told to stay home, which leads to even more supply chain chaos when ports have to scramble with backlogs and deteriorating operations.

With COVID Things Will Probably Get Worse Before They Get Better

Given the transmissibility of Omicron and the strong desire of China’s officials to not let it get out of hand, rolling lockdowns should be expected to continue in China. The risk for social unrest stemming from them is now rising.

Gauging the impact of these forces on China’s port operations will not only be fascinating but also essential for businesses trying to maintain a handle on their supply chain issues. Solutions like Enhanced Satellite AIS can help bring light to a challenging, murky situation.

Written by

Written by