Charting the skies: Global aviation recovery

- Introduction

- Narrowbody fleet overview

- Widebody fleet overview

- Flight capacity transformation of the top narrow and widebody aircraft leaders

- Comparative analysis: Passenger vs. cargo flight operations of narrow and widebody aircraft

- Gateway giants: Identifying top departure airports for top narrow and widebody aircraft

- Flight patterns unveiled: Mapping the busiest narrow and widebody routes of 2023

- Conclusion

AviationValues and Spire Aviation have collaborated and combined extensive datasets to provide an in-depth analysis of the global aviation recovery. Looking at values, fleet developments, flight trends and global activity distributions.

![]()

![]()

Introduction

In the wake of the Covid-19 pandemic, the global aviation sector has experienced a significant transformation. Newer technology airframes took centre stage during the initial recovery process. However, as demand rebounded more strongly than anticipated, supply chains have not been able to keep up. Continued delivery challenges and delays in the certification of specific new technology models, as well as the proven reliability of mature technology, have resulted in strong interest in older technology airframe types since 2023. This article aims to dissect the aviation landscape of 2023 and 2024, focusing on the top six airframes that have led the charge in terms of flight frequency.

Airframes for 2023/2024 (based on the number of flights):

| Narrowbody: | Widebody: | ||

| Airframe type | Manufacturer | Airframe type | Manufacturer |

| B738 (737-800) | Boeing | B77W (777-300ER) | Boeing |

| A320 (A320ceo) | Airbus | B763 (767-300/300ER) | Boeing |

| A20N (A320neo) | Airbus | A333 (A330-300) | Airbus |

| A321 (A321ceo) | Airbus | B789 (787-9) | Boeing |

| B38M (737 MAX 8) | Boeing | A359 (A350-900) | Airbus |

| A21N (A321neo) | Airbus | A332 (A330-200) | Airbus |

We will explore the implications of these leading airframes for operators, routes, and the overall market dynamics, offering insights into how they reflect the industry’s adaptation and resilience.

By examining the interplay between airframe capabilities and market demands, this piece will provide a concise yet comprehensive overview of the current state of global aviation, highlighting the strategic shifts and innovations that are defining the future of air travel.

Leading aircraft types fleet & operator analysis

Narrowbody fleet overview

| Airframe | Tech | Number of Aircraft | Production Run | Average Age | Market Value USD bn |

| B738 (737-800) | Old | 4,696 | 1998 – 2020 | 12.53 | 81.40 |

| A320 (A320ceo) | New | 1,913 | 2014 – current | 3.62 | 69.90 |

| A20N (A320neo) | Old | 4,090 | 1988 – 2021 | 13.92 | 62.35 |

| A321 (A321ceo) | New | 1,279 | 2016 – current | 2.51 | 60.85 |

| B38M (737 MAX 8) | New | 1,234 | 2017 – current | 2.68 | 49.76 |

| A21N (A321neo) | Old | 1,652 | 1995 – 2021 | 11.46 | 36.90 |

| Total | 14,864 | 361.17 |

Source: AviationValues

Preeminent by a significant margin amongst the main narrowbody fleet types in service today are the B738 (737-800) and A320 (A320ceo), which together comprise 59% by aircraft count. Both these airframe types have had very long production runs, but have recently been superseded on the assembly line by the B38M (737 MAX 8) and A21N (A321neo) respectively. Consequently, their aggregate share of the fleet by Market Value is now at just under 40%, although the B738 retains the leading spot across the leading narrowbody models.

The B738, B38M, A320 and A20N serve what has historically been the core narrowbody capacity segment: both the B738 and B38M have maximum seating for 189 passengers (the MAX 8 200 subvariant being an exception, with high density seating for up to 200). The A320 and A20N can accommodate slightly more than their standard Boeing competitors, seating up to 195 passengers. However, many operators operate these aircraft at lower seating densities, with two class layouts for between 140 and 172 passengers being typical across these four airframe types.

The centre of gravity of this core has been gradually moving upwards. The backlog for the A21N has surpassed that of the A20N backlog, which is a feat the A321 never came close to accomplishing versus the A320. Boeing’s competing B3XM (737 MAX 10) also has a strong orderbook, although it is yet to be certified and its timeline for entry into service remains a question mark.

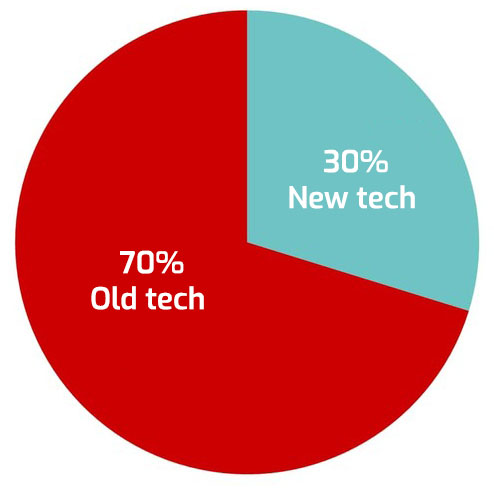

With such a large number of aircraft to replace, old technology aircraft still account for 70% of the narrowbody fleet.

Narrowbody by new tech vs old tech

Source: AviationValues March 2024

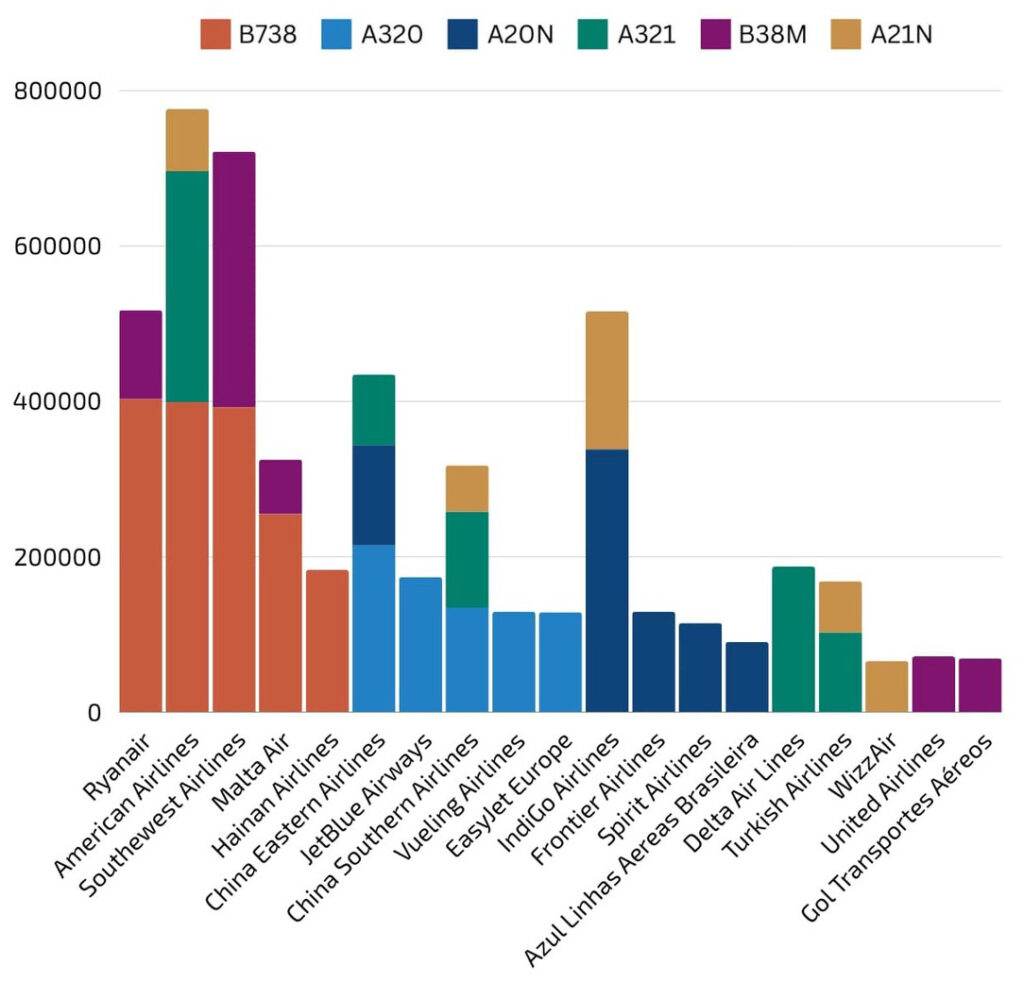

Top operators for narrowbody aircraft (based on the number of flights)

Source: Spire Aviation

In Asia, the A320’s presence is notably supported by two major Chinese carriers, China Eastern and China Southern, alongside an unexpectedly robust operation by EasyJet Europe. Meanwhile, routes to South America are primarily served by JetBlue and Vueling. The global network of the busiest B38M routes benefits from a diverse mix of carriers, from low cost options like Ryanair and Malta Air to traditional airlines such as Southwest and United Airlines. This pattern is similarly observed with the B738, where Ryanair and Malta Air are predominantly focused on European routes, which have not been highlighted among the busiest ones in our analysis.

Widebody fleet overview

| Airframe | Tech | Number of Aircraft | Production Run | Average Age | Market Value USD bn |

| B77W (777-300ER) | Old | 816 | 2004 – 2022 | 11.06 | 33.43 |

| A333 (A330-300) | Old | 686 | 1993 – 2022 | 12.52 | 13.66 |

| B789 (787-9) | New | 626 | 2014 – current | 5.72 | 53.90 |

| A359 (A350-900) | New | 501 | 2014 – current | 4.50 | 51.74 |

| A332 (A330-200) | Old | 478 | 1998 – 2019 | 14.87 | 7.82 |

| B763 (767-300/300ER) | Old | 280 | 1986 – 2014 | 24.27 | 2.54 |

| Total | 3,387 | 163.08 |

Source: AviationValues

From a fleet count perspective, the picture of the leading widebody types in current service presents a somewhat more balanced picture: the proportion of the narrowbody fleet that is dominated by two models is split across three in the widebody sector: the B77W (777-300ER), A333 (A330-300) and B789 (787-9). The two most popular widebody models account for 44%.

By Market Value, the difference between the current production of new technology models and the older technology types is stark: the B789 and A359 (A350-900) comprise nearly two thirds of the leading widebody fleet’s Market Value despite only accounting for one third by aircraft count. By contrast, the B763 (767-300/300ER), as the model that has been out of production the longest, comprises less than 2% of the aggregate Market Value. It clearly continues to have a significant presence in terms of fleet count, but is sunsetting.

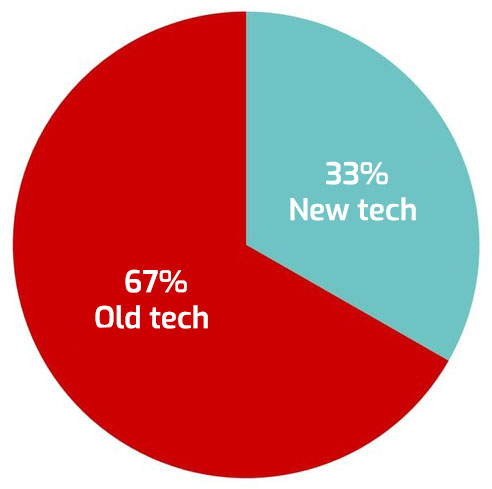

Widebodies have tended to have somewhat shorter replacement cycles than narrowbodies, and this is reflected in the slightly larger share of new technology widebodies as compared to the narrowbody fleet. However, both manufacturers face challenges in increasing the pace of replacement with new technology model deliveries. Boeing’s 777X programme has faced significant delays in gaining entry into service: originally slated for 2020, the manufacturer has indicated 2025 as its target, but recent comments from the aircraft’s largest customer Emirates hint at 2026.

This has primarily benefitted the B77W, which as the largest twinjet has also been the main recipient of traffic that had previously been carried by the largest widebody quadjets, the Boeing 747 and Airbus A380, where carriers had opted to permanently retire those aircraft after the pandemic.

Widebody by new vs old tech:

Source: AviationValues March 2024

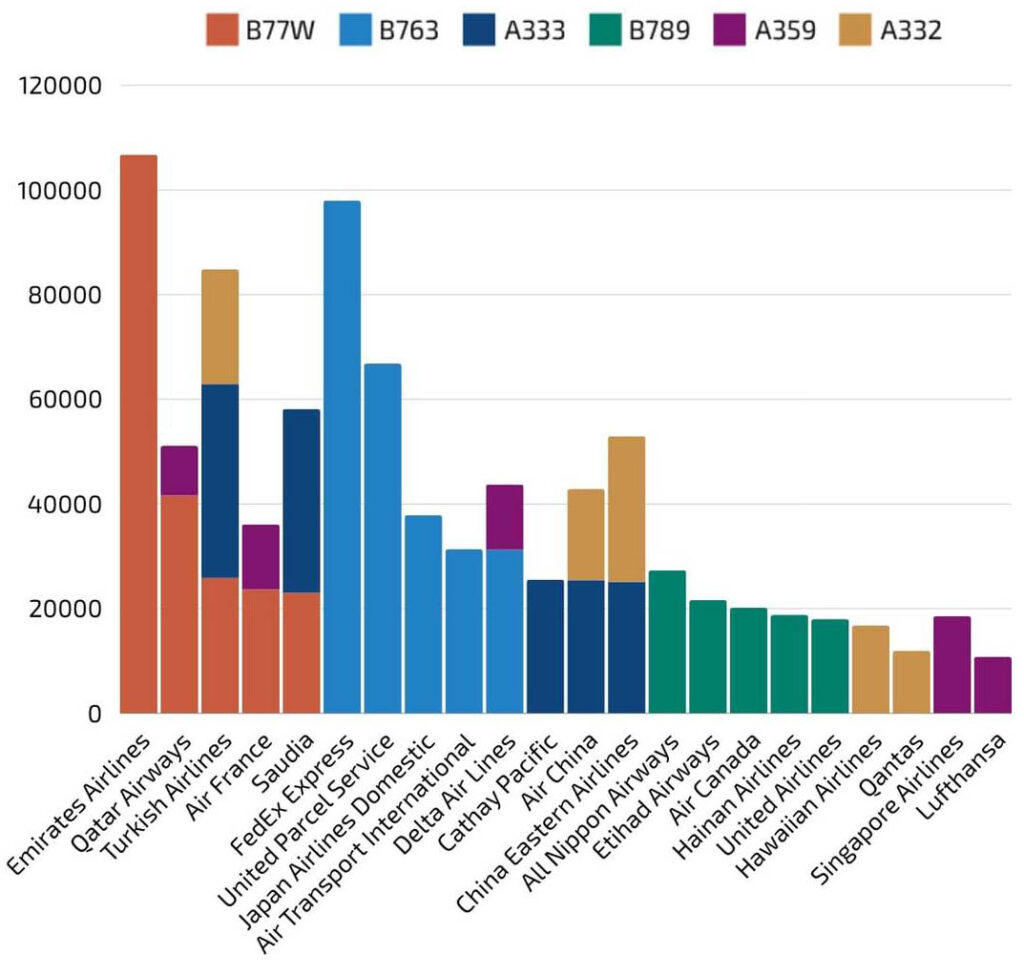

Top operators for widebody aircraft (based on the number of flights)

Source: Spire Aviation

The A332 (A330-200) model sees a notable presence in China through primary operators Air China and China Eastern. Hawaiian Airlines is also a significant A332 operator, deploying the aircraft on trunk connections to the US mainland.

Middle Eastern routes utilising the A333 (A330-300) are predominantly served by Saudi and Turkish Airlines, while the B77W (777-300ER) adds Emirates and Qatar Airlines to its roster, expanding the network.

In Asia, the A333’s operations are led by Air China and China Eastern. Although the B789 busiest routes were between different Chinese cities, these are operated by diverse international leaders like All Nippon, Etihad, Air Canada, Hainan, and United Airlines.

Singapore Airlines and Lufthansa dominate the A359 (A350-900) routes connecting Japanese cities, contrasting with the B763 (767-300/300ER), primarily in the hands of cargo giants FedEx, United Parcel, and Air Transport, alongside Japan Airlines Domestic for domestic flights, showcasing a concentration of operations within Japan.

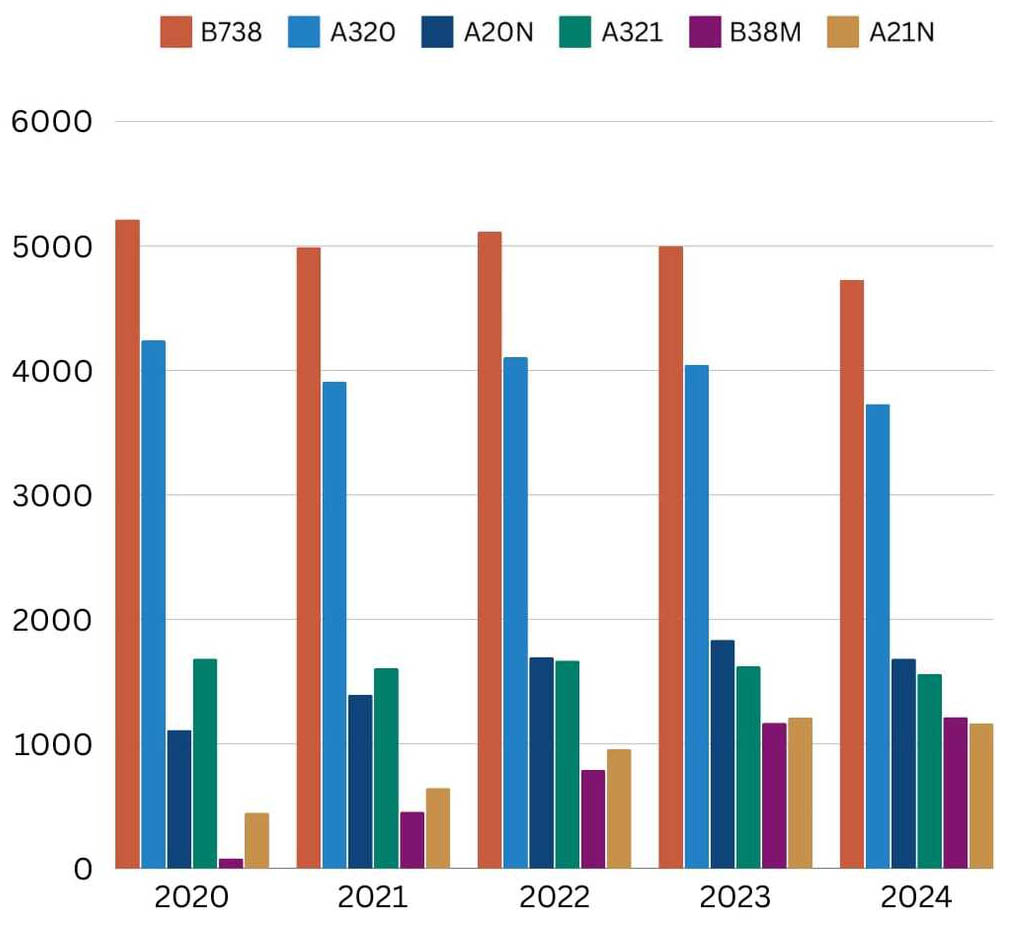

Flight capacity transformation of the top narrow and widebody aircraft leaders

Source: Spire Aviation

Reviewing the top narrowbody aircraft reveals consistent leaders, with the B738 leading at approximately 5,000 active aircraft and the A320 following with about 4,000 active aircraft over the past four years. A shift is observed in third place since 2022, with the A20N surpassing the A321, reaching almost 1700 aircraft in 2024, while the A321 remains close behind with approximately 1600. Looking back to Covid-19 times in 2020, the B38M had only 80 active aircraft, yet it has gradually increased annually, overtaking the A21N in 2024 with over 1200. Although our analysis is limited to the first quarter of 2024, the evolving competition, particularly for the fifth position, remains a point of interest as the year progresses.

Change in the number of aircraft by top operating narrowbody aircraft over the years

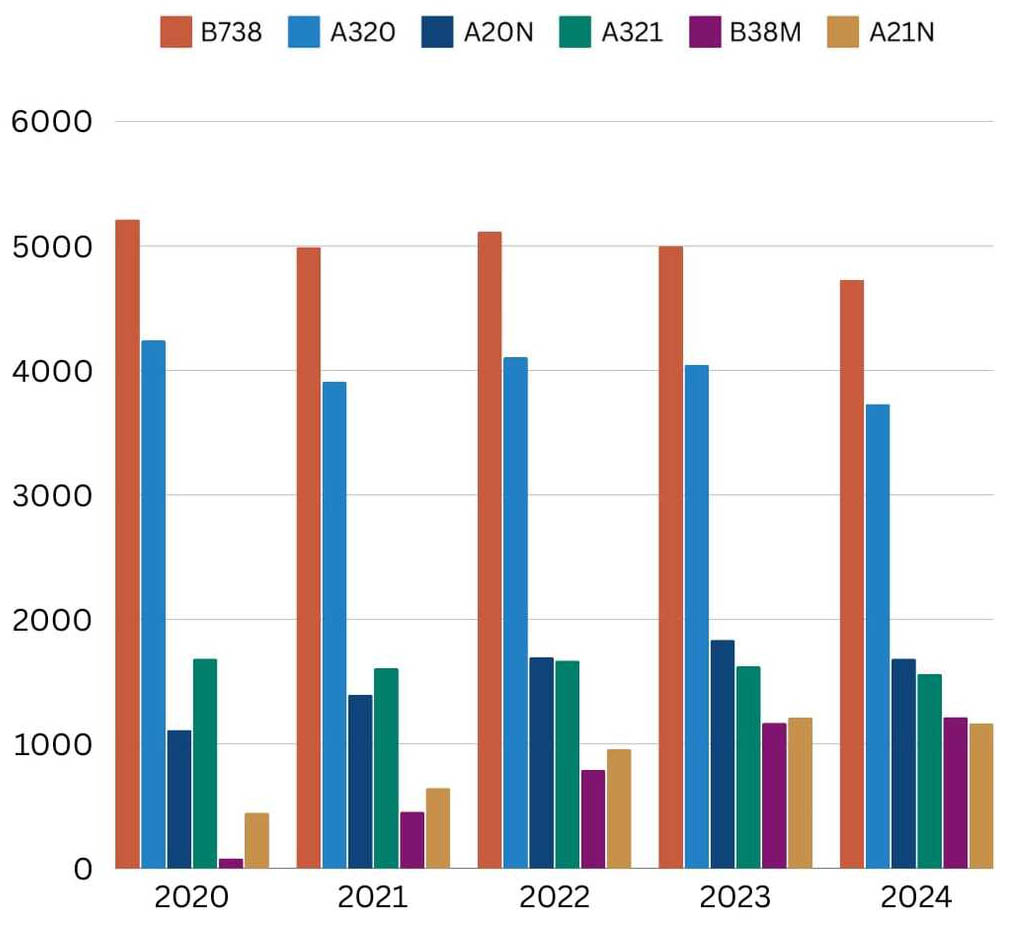

In the widebody aircraft category, the B77W stands out as the clear leader, operating about 800 active aircraft on average annually. The competition for second place is closely contested between Boeing and Airbus models. The A333 was ahead in 2020, but by 2022, the B763 reached parity in the number of active aircraft and then exceeded its Airbus counterpart by 30 in 2023 and it continues the trend into the first quarter of 2024. Another Boeing model, the B789, has also seen a slight increase in the number of operating aircraft, moving from around 500 to over 600 in the early part of 2024. Among the remaining top aircraft, Airbus models are vying for dominance, with the A359 nearly matching the A332’s fleet size last year and surpassing it in the first quarter of 2024.

Change in the number of active aircraft by top operating widebody aircraft over the years

Source: Spire Aviation

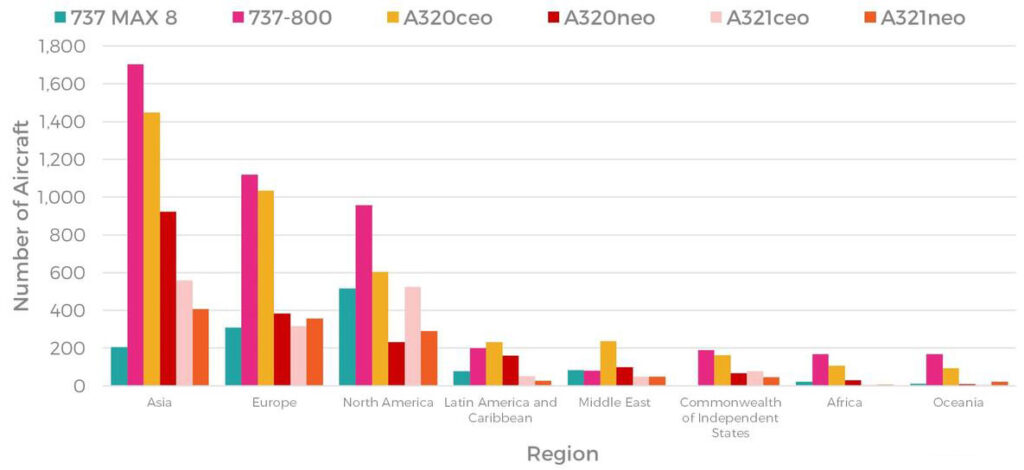

Narrowbody aircraft by regional spread

Source: AviationValues March 2024

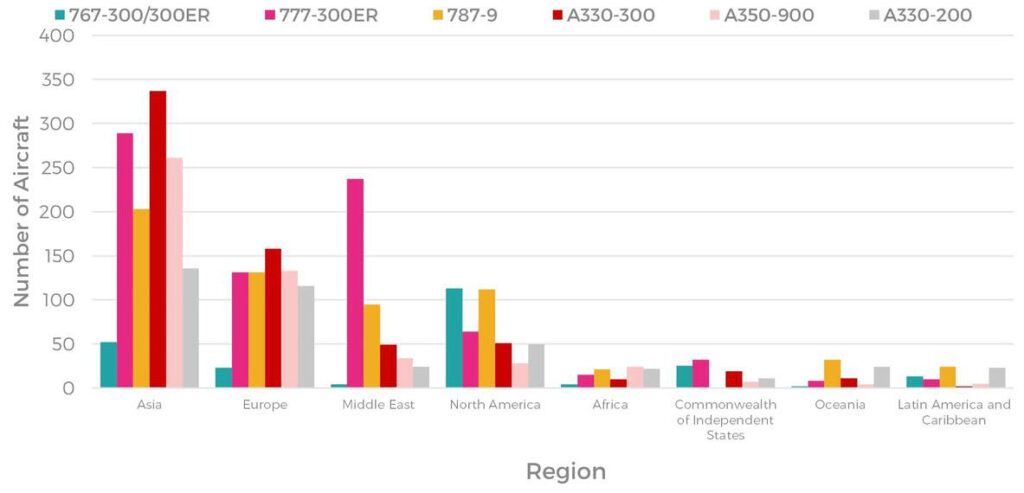

Widebody aircraft by regional spread

Source: AviationValues March 2024

| Region | Widebody Fleet Rank by Fleet Count | Narrowbody Fleet Rank by Fleet Count | Overall Fleet Rank by Fleet Count |

| Asia | 1 | 1 | 1 |

| Europe | 2 | 2 | 2 |

| North America | 4 | 3 | 3 |

| Middle East | 3 | 5 | 4 |

| Latin America and Caribbean | 8 | 4 | 5 |

| Commonwealth of Independent States | 6 | 6 | 6 |

| Africa | 5 | 7 | 7 |

| Oceania | 7 | 8 | 8 |

An analysis of these leading aircraft type fleets by region reveals some interesting insights:

- The B738 (737-800) is the standout star of the 737 Next Generation family. The A320 (A320ceo) is scarcely less popular, and its larger sibling the A321 (A321ceo) is also well represented across regions

- While North America is ranked third overall, it operates a diverse fleet of narrowbodies that are not represented in the leading global types, particularly other members of the Boeing 737 Next Generation family such as the 737-700 (557) and 737-900/900ER (402)

- The Middle East is a region of widebodies (and adding Emirates’ fleet of 131 Airbus A380s to the consideration would underscore that even further) whereas North America appears relatively underweight given its overall size. This speaks to the difference in market dynamics: the Middle East is primarily a connecting region for global long haul travel, whereas North America is primarily short to medium haul domestic and intra-regional operations

- Asia’s sheer population and geographic size mean that it has both large domestic markets (China, Japan, India) and far flung regional population centres that demand both narrowbody and regional connectivity. The A333 (A330-300) and B77W (777-300ER) are the widebody regional workhorses, with the A320 and B738 dominating amongst narrowbodies

Comparative analysis: Passenger vs. cargo flight operations of narrow and widebody aircraft

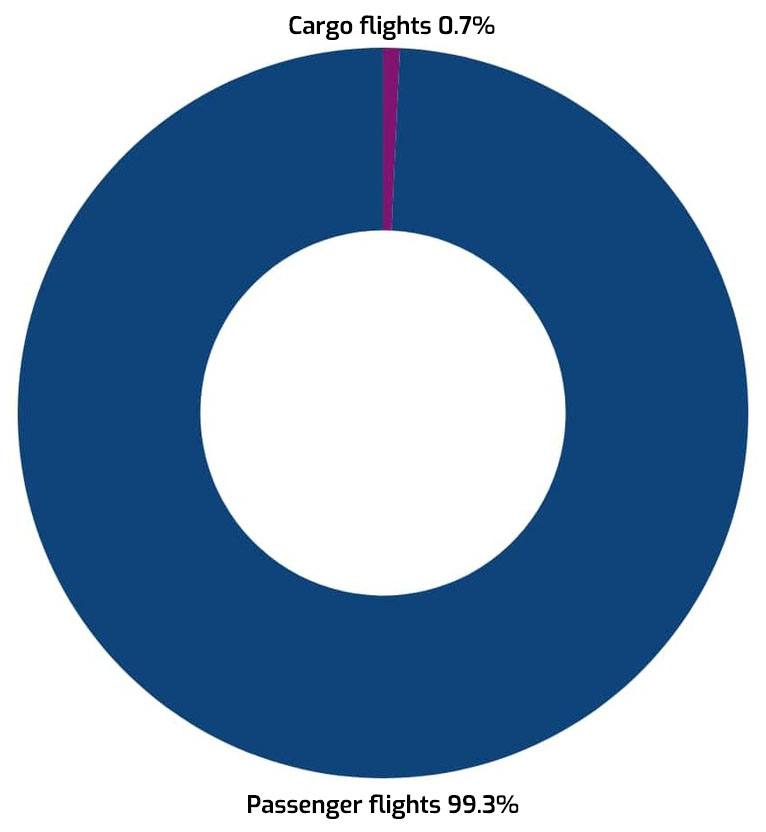

Passenger vs cargo flights operated in 2023 by narrowbody aircraft

Let’s delve deeper into the varied operational purposes of aircraft, focusing particularly on how they’re employed across the aviation sector. Among the myriad of narrowbody aircraft models, the B738 and A321 emerge as versatile players. These models uniquely straddle the worlds of both cargo and passenger aviation, showcasing their adaptability and critical role in global logistics and passenger transport.

| Airframe | Freighter version? | Factory built fleet | Passenger conversion fleet | Factory built backlog |

| B738 (737-800) | Y | n/a | 177 | n/a |

| A320 (A320ceo) | Y | n/a | 0 | n/a |

| A20N (A320neo) | N | n/a | 0 | n/a |

| A321 (A321ceo) | Y | n/a | 40 | n/a |

| B38M (737 MAX 8) | N | n/a | 0 | n/a |

| A21N (A321neo) | N | n/a | 0 | n/a |

| Total | 217 |

Source: AviationValues

While these two models demonstrate a broad scope of applications, the majority of narrowbody fleets are still primarily tasked with commercial passenger operations, catering to the global demand for passenger travel with only a very small proportion allocated for private flights.

Source: Spire Aviation

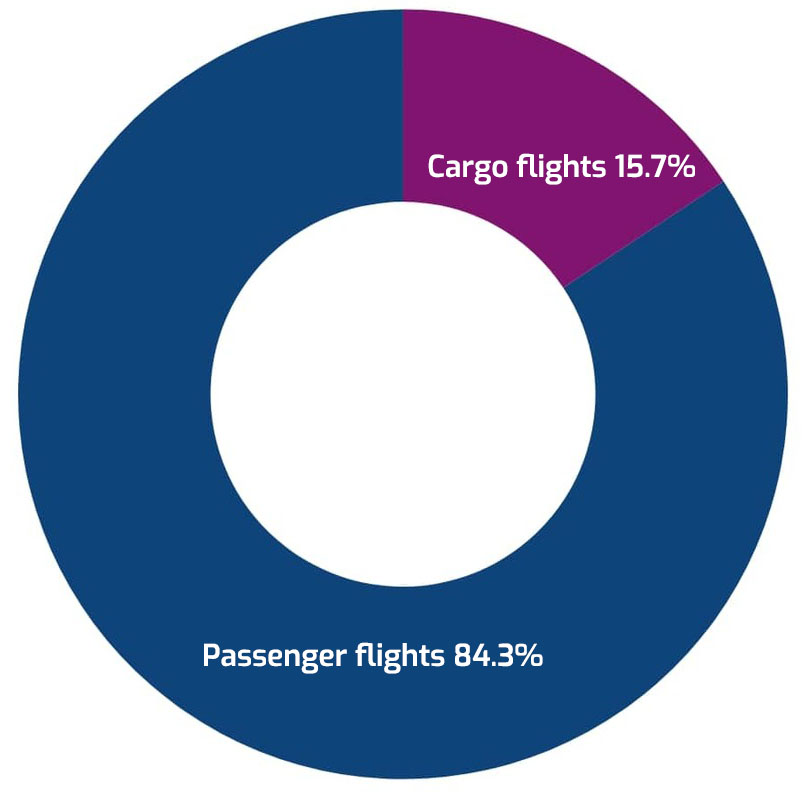

Passenger vs cargo utilization by widebody aircraft

When shifting our focus to widebody aircraft, the scenario changes markedly. Apart from the B77W, B789, and A359, which currently only serve commercial passenger routes (although the freighter conversion for the B77W is nearing service entry and Airbus’ factory built A350F has a backlog of 55 orders), the majority of other leading widebody models are utilized for both commercial and cargo operations.

| Airframe | Freighter version? | Factory built fleet | Passenger conversion fleet | Factory built backlog |

| B77W (777-300ER) | Y | N | 0 | n/a |

| A333 (A330-300) | Y | N | 19 | n/a |

| B789 (787-9) | N | n/a | n/a | n/a |

| A359 (A350-900) | Y* | 0 | 0 | 55* |

| A332 (A330-200)** | Y | 38 | 10 | 0 |

| B763 (767-300/300ER) | Y | 245 | 202 | 28 |

| Total | 283 | 231 | 83 |

Source: AviationValues

* A350F factory built freighter is a distinct A350 variant based on a shortened A350-1000 platform, not the A350-900

** A330-200F factory built freighter features a lengthened nose landing gear to enable a level cargo deck. This feature is not available on passenger conversions

As illustrated earlier in this article, AviationValues’ fleet data shows that the B763 (767-300/300ER) has been out of production as a passenger model for ten years now. In that time it has enjoyed commercial success as a freighter conversion platform. A factory built freighter is also in production. As a result, in recent years the B763 has been more frequently deployed for cargo missions than passenger services, thereby securing its position as the foremost cargo aircraft among widebody models.

Source: Spire Aviation

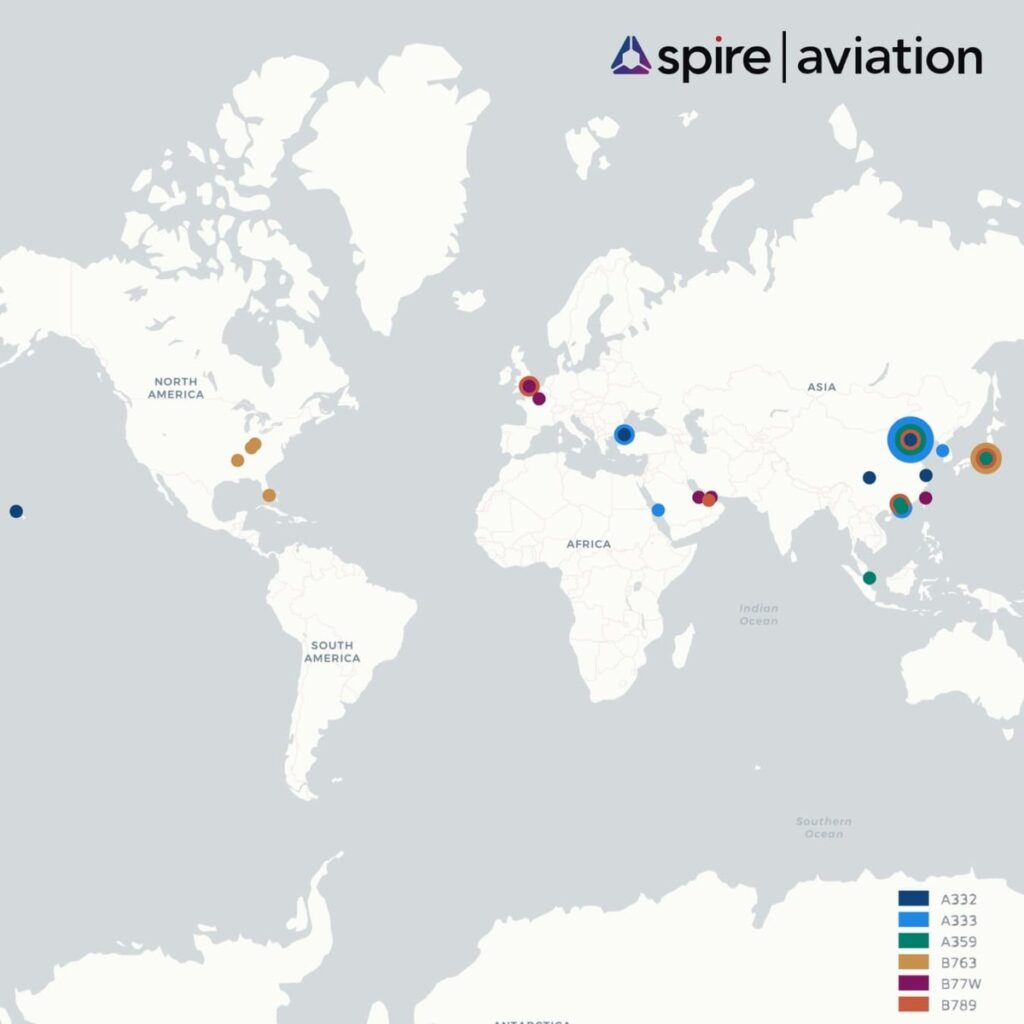

Gateway giants: Identifying top departure airports for top narrow and widebody aircraft

Top departure airports for leading narrowbody aircraft

Having analysed the leading narrowbody aircraft operators, let’s dive into the busiest departure airports for these aircraft.

Looking at Airbus’s prime narrowbody contenders, their busiest airports are located in India, Turkey, and the United States. The A20N and A21N primarily serve routes in India, whereas the A321 has a stronger presence in the US. The Airbus model with a global spread of the busiest airports is the A320, operating out of South America (Bogotá), Europe (Paris and Barcelona) and Asia (Jakarta and Kuala Lumpur).

On the Boeing front, both the B38M and B738 models are most prominently represented in the US (Dallas) with the B738 additionally operating in China (Yunnan and Shenzhen).

Top departure airports for leading widebody aircraft

Turning to widebody aircraft, their notable footprint in Asia, especially China, becomes apparent. Beijing tops the list of the busiest airports for the majority of aircraft (A332, A333, A359, and B789), with Hong Kong following closely for the A333 and A359. The A332 also operates significantly from Chengdu and Shanghai.

Widebody operations also feature strongly in the Middle East, with the B789, B77W, and A333 making their mark. Routes served by widebodies tend to be more limited across both North and South America: only the B763 makes the global list of most active routes, and only from North America.

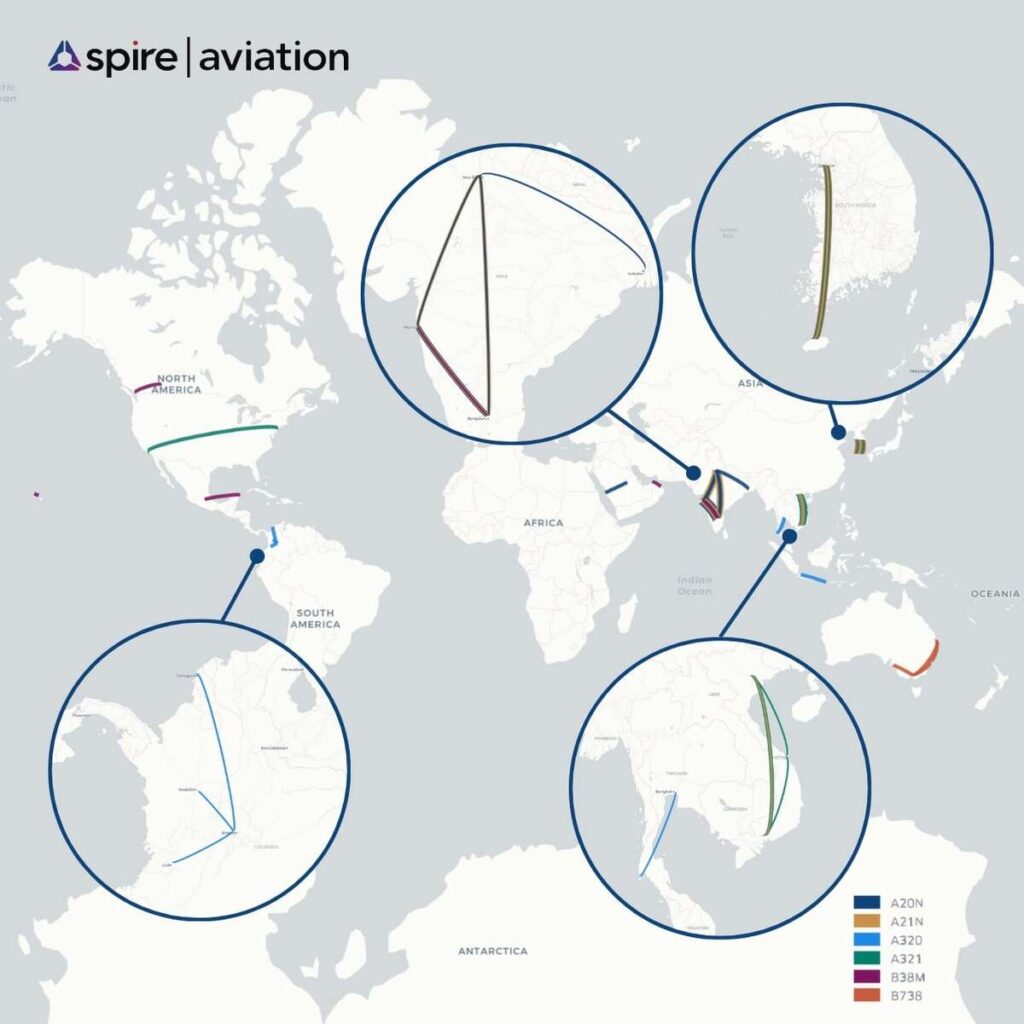

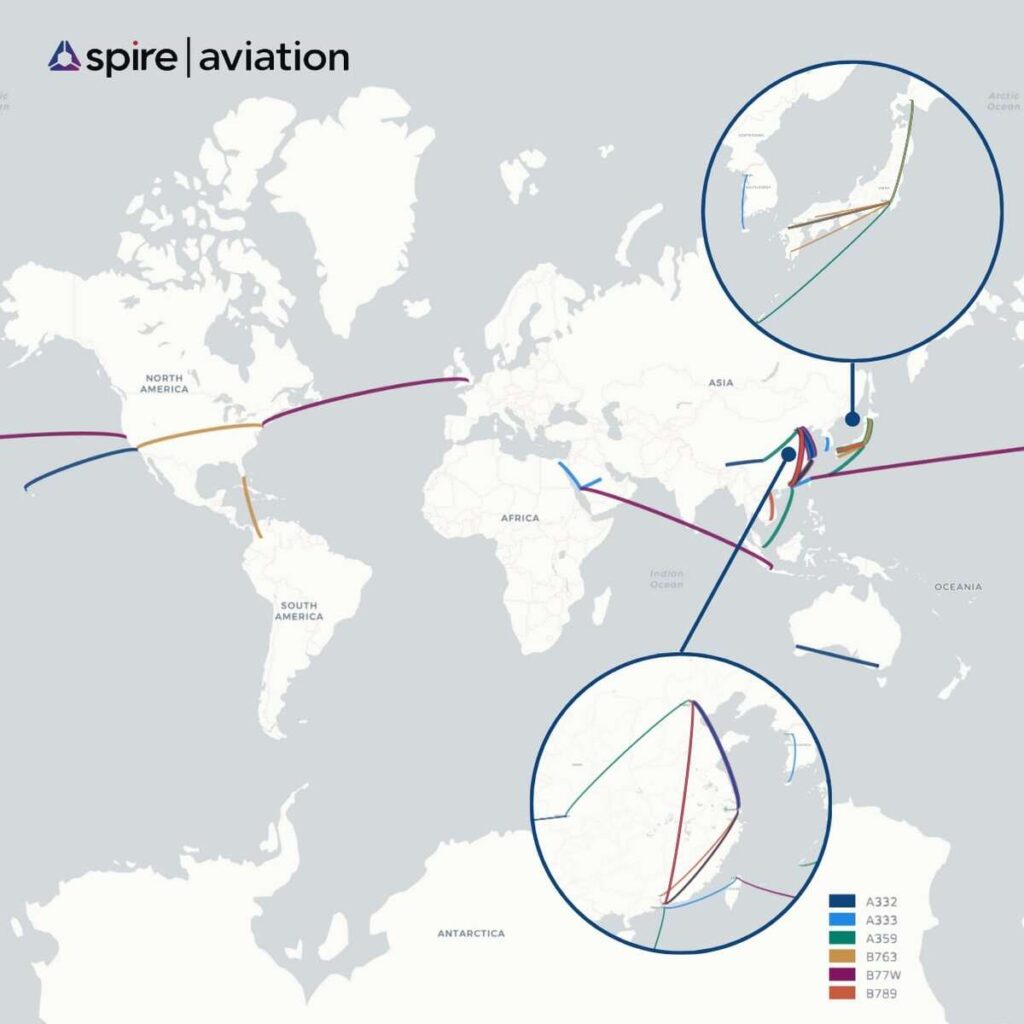

Flight patterns unveiled: Mapping the busiest narrow and widebody routes of 2023

Busiest regional and intercontinental routes of narrowbody aircraft in 2023

Delving into the top five routes, excluding round trips to the same airport, we found that the A20N and A21N mainly cater to the increasing demand of India’s domestic market, linking Mumbai and New Delhi with Bengaluru, and the A20N extending the connection to Kolkata as well. The A20N also serves high demand routes in the Middle East, connecting Jeddah and Riyadh in Saudi Arabia. The A21N’s most frequently flown routes also include domestic travel between two Indian airports (Mumbai – New Delhi) and domestic routes within Korea (Seoul – Jeju).

The narrowbody presence in Asia is not surprising based on the previously analysed busiest airport data. This trend continues with the other Airbus models (A320 and A321), where the A320 connects destinations in Indonesia and Thailand, and the A321’s prime routes facilitate domestic travel within Vietnam.

Among all the narrowbodies, the A320 is the only one with the busiest routes in South America, more specifically within Colombia. The B38M showcases the broadest global presence, with routes making the global busiest routes list in North America (Vancouver – Calgary, Hawaiian interisland); Central America (Mexico City – Cancún); Asia (Mumbai – Bengaluru); and the Middle East (Dubai – Muscat). Rounding out the narrowbodies is the B738, whose busiest routes are focused within Australia and South Korea.

Busiest regional and intercontinental routes of widebody aircraft in 2023

The correlation between route analysis and the busiest airports data reveals a distinct pattern, especially the prevalence of widebody aircraft serving China, Japan and South Korea, where they facilitate a higher volume of connections compared to narrowbody counterparts.

In China, the A332 leads in establishing key connections, linking major cities like Beijing with Shanghai, Lhasa with Chengdu, and Shenzhen with Shanghai. The B789 is also notable for its routes between Shenzhen and Shanghai, Guangzhou and Shanghai, and Beijing and Shenzhen. Additionally, the Beijing route is catered to by the A333 and B77W.

In South Korea, the A333 also connects Jeju to Seoul (Gimpo), while the A359 features heavily on domestic Japanese corridors to Tokyo from Sapporo, Fukuoka and Okinawa. The Tokyo market is also served strongly by the B763 from Sapporo, Hiroshima, and Kagoshima.

In the Middle East, the A333 and B77W stand out as the leading widebody models serving this region, with significant routes including Cairo – Jeddah (A333) Jeddah – Riyadh (A333), Jeddah – Jakarta (B77W).

In the Americas, the B763 is a stalwart of the key New York – Los Angeles transcontinental route, as well as services between Miami and Bogotá. The busiest transatlantic route between New York and London Heathrow is served by the B77W, which also serves the transpacific route connecting San Francisco to Taipei. The A332 serves the main Honolulu – Los Angeles service linking Hawaii with the US mainland.

Conclusion

In the wake of the Covid-19 pandemic, the global aviation sector has undergone significant transformations. Newer technology airframes took centre stage during the initial recovery process, but in more recent months older technology types have experienced a resurgence as demand has rebounded faster than the available supply. The main aircraft types are firmly entrenched, stalwarts of the markets they serve. Geographic distinctions between markets may favour one type over another, but in general the leading aircraft types are all global players.

Beyond satisfying intellectual curiosity, knowing the market dynamics of each region and the aircraft and operators that serve it, is fundamental to making good investment decisions. The analysis above is merely scratching the surface of the potential insights available from Spire Aviation and AviationValues data. Get in touch to know and understand more.

Harnessing the power of aviation analytics

In an era where data-driven insights are essential for success, space-based ADS-B data stands at the forefront of aviation analytics. The unique advantage of space-based ADS-B data lies in its ability to track aircraft positions even in remote and oceanic regions where ground-based infrastructure is limited or non-existent. This rich global dataset empowers stakeholders, including airlines, air traffic management organizations, and industry analysts, to better understand flight patterns, congestion hotspots, and operational inefficiencies to make informed decisions regarding route optimization, airspace management, and fleet planning.

Written by

Written by