How air cargo moves: Main hubs, routes, and the future of global freight

The global economy relies on the fast, reliable movement of goods every second of every day and air cargo is a key player in that system.

From critical medical supplies to consumer electronics, air freight carries some of the world’s most valuable and time-sensitive shipments. But the changes in manufacturing, trade policies, technology, and consumer behavior are redrawing the map of where and how air cargo moves. New hubs are emerging, old ones are evolving, and cargo routes are being redrawn to meet the demands of a rapidly shifting global economy.

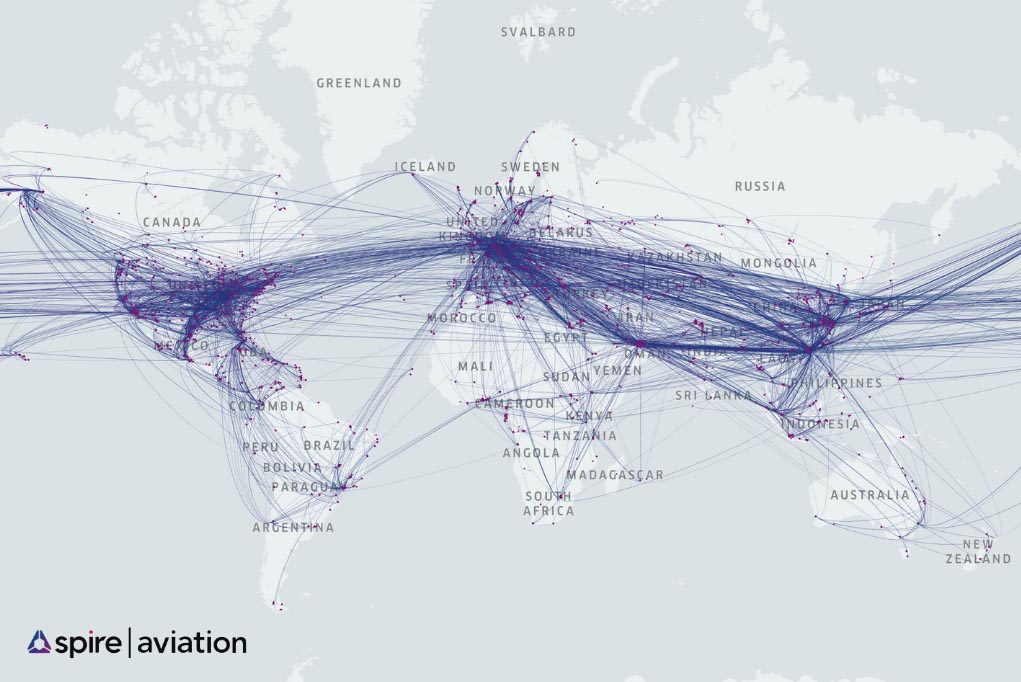

A study led by Bernardo Puente-Mejia and Anne Lange from the Frankfurt University of Applied Sciences published in the Journal of Transport Geography explores these patterns, offering valuable insights into the changing distribution of air cargo, the rise and fall of key hubs, and the emergence of new strategic connections and what that means for the future of logistics. The researchers mapped these air cargo flows using global flight data powered by Spire Aviation. This multi-source ground and satellite-enabled data fusion offers a complete, uninterrupted view of global aircraft movements—including in remote regions and over oceans where traditional ground-based ADS-B coverage fails.

For those interested in the detailed research, explore the full study on Global Air Cargo Operations.

“By segmenting the entire world into individual logistics archetypes, we show that cargo strategy is not about chasing one-size-fits-all markets, but rather matching the right aircraft, product, policy and similar players to each archetype’s unique characteristics.”

Share on Facebook Share on Twitter Share on LinkedIn

The changing geography of air cargo

For years, global air cargo routes followed predictable patterns, dominated by a few core regions and trade flows. But over the last two the rise of e-commerce, which requires new last-mile and regional logistics, decentralized manufacturing, as companies diversify beyond China and strategic airline investments in underserved markets. The researchers looked into how the traditional trade zones and routes interact across the globe.

What the research did:

- Built a comprehensive operational dataset – 4 million dedicated-freighter flights observed in 2022(ADS-B, Spire Aviation) spanning 1660 airports and 251 airlines were cleaned, fuel-stop-corrected and merged with macro-economic and infrastructure indicators for 111 countries—covering 92 % of global GDP.

- Found the drivers of flight intensity with ordinary least squares – Three OLS models (all flights, express, general cargo) revealed that international-flight shareand first-degree connectivity are the strongest positive predictors, while large land area depresses freighter frequency; flown-freight tonnes matter only in general-cargo markets.

- Bench-tested seven clustering algorithms and chose the best – K-means, spectral, agglomerative, DBSCAN, HDBSCAN, mean-shift and affinity-propagation were scored with Silhouette and Calinski–Harabasz indices; K-means (6 clusters) won for express traffic, spectral clustering (4 clusters) for general cargo, balancing statistical strength with interpretability.

- Expanded the clusters into ten “Air-Cargo Logistics Archetypes” – Each archetype blends country context, centroid weights and mapped origin-destination lanes to tell a coherent logistics story.

Global air cargo flight density for January 2025

Archetypes at a glance

- Integrator Super-Hubs – high-income, high-capacity, dominated by express parcels (e.g., US, Germany).

- Manufacturing Platforms – strong export orientation, balanced integrator/general traffic (e.g., Canada, Mexico).

- Gateway Transhipment Nodes – infrastructure-rich states leveraging geography more than domestic demand (e.g., Qatar, UAE).

- Resource-Driven Cargo Origins – bulk perishables or extractives, limited inbound volumes (e.g., Chile, Kenya).

- Emergent Regional Feeders – growing middle class, upgrading airports, still below global density average (e.g., Latin America, Africa).

Why it matters?

- Strategy: Airlines can tailor fleet and product (express, perishables, e-commerce) to an archetype’s signature demand profile.

- Policy & infrastructure – Policymakers can use the proposed archetypes to prioritize investments and policy interventions that align with different markets’ specific needs and characteristics.

- Sustainability – Right-sizing capacity to archetype-specific flow density can potentially cut CO₂ per tonne-km due to a more efficient routing.

- Resilience – Diversifying routings across contrasting archetypes buffers shocks such as pandemic-era capacity crunches and geopolitical reroutes.

Rethinking connections: New routes and alliances

Air cargo connectivity is no longer just about long-haul flights between major cities. The industry is evolving to reflect new priorities and pressures.

Key trends:

- Shorter, faster routes for regional fulfillment (e.g., Southeast Asia to India or Africa to Europe)

- Multi-stop freighter networks, connecting multiple second-tier cities in a single loop

- Cargo-only airlines and alliances expanding into logistic corridors, especially in Africa and Latin America

Technology also plays a role. Airlines now use data-driven planning to optimize cargo loads and minimize empty space, allowing for more flexible, responsive route planning.

Implications for the future of air cargo

These shifts point to a broader transformation in how goods move around the world:

- Air cargo is becoming less centralized. Instead of a few dominant airports, a wider web of regional hubs is emerging.

- Flexibility and speed are now more important than volume alone, especially in the age of on-demand delivery.

- Emerging markets are not just cargo origins; they’re becoming major transit and destination points in their own right.

Conclusion: A more complex, connected air cargo network

Air cargo today is no longer just about connecting New York, London, and Tokyo. It’s about linking Hanoi to Nairobi, São Paulo to Johannesburg, and Shanghai to Doha. The rise of new hubs, the redistribution of trade flows, and the integration of technology are shaping an air freight system that is faster, more resilient, and more globally inclusive.

Whether you’re tracking a package or studying the structure of global trade, understanding the changing nature of air cargo gives a clearer view of how the world is moving. Analysing air cargo flight traffic to understand cargo routes, aircraft type, capacity, frequency and freighter airline operations have become fast and easier than ever thanks to global flight data powered by multi-source ground and space-based ADS-B.