Charting the future of Maritime insurance: Concirrus and Spire Maritime

Concirrus is implementing artificial intelligence (AI) to help its customers in the insurance market gain a step-change competitive advantage, and develop new, innovative insurance products using satellite-based data.

An Introduction to satellite data in the insurance industry

In leveraging Concirrus’ Machine Learning models, maritime insurance companies improve their risk assessment and claims management processes whilst greatly improving efficiencies in underwriting processes.

Combining strong data analytics with machine learning has a positive impact on efficiency, accuracy, and profitability of the maritime insurance industry – and creates a safer voyage for cargo and everyone at sea.

The maritime insurance industry faces numerous challenges, including assessing risks accurately, managing claims efficiently, and optimizing underwriting decisions. These challenges are being addressed head-on by Concirrus, who have adopted Artificial Intelligence models to improve their client’s overall performance.

Risk Assessment

Concirrus’ AI algorithms analyze vast amounts of maritime data across the insurance market and directly from Spire – including historical vessel performance, cargo types, routes, weather patterns, and navigation conditions. By applying machine learning (ML) models to this data, Concirrus develops a competitive advantage for their clients in risk assessment that helps predict the likelihood of accidents, damage to cargo, or other maritime incidents.

Most businesses are not equipped to process such large quantities of data. Concirrus says that there is a wealth of data in the insurance industry but companies are typically not positioned to process such vast quantities of analytics. By leveraging data feeds and training AI models, maritime insurers can use Concirrus’ models to offer customized real-time risk assessment to influence pricing decisions and assist with portfolio management. Concirrus says that, in the future, rather than writing a traditional 12-month policy, they want to enable market leaders to take that leap and create new dynamic policies that give customer rolling premiums based on continuous data feeds and risk assessment. This is something that simply wasn’t possible in the past.

Claims Management

With the adoption of this AI strategy combined with the accuracy of Spire’s data, Concirrus can automate and streamline offerings for their client’s claims management, saving time and money.

Concirrus can analyze real-time and historical data, including vessel tracking systems, weather data, and much more. This allows insurance companies to detect potential fraudulent claims, expedites the assessment process, and enables prompt settlements. Moreover, these algorithms help identify patterns and trends in claims data, enabling Concirrus to develop proactive risk management strategies and improve loss ratios for the insurance industry.

Underwriting

Leveraging AI algorithms and satellite-based data optimizes underwriting decisions and pricing strategies for Concirrus’ clients. By analyzing a wide range of data, including vessel specifications, historical claims data, crew experience, and market trends, AI algorithms identify risk factors and estimate potential losses accurately. This allows Concirrus’ clients to offer competitive premiums, attract low-risk clients, and optimize the balance between profitability and customer satisfaction.

Benefits and Results

The adoption of Concirrus’ artificial intelligence yields several benefits for the insurance industry. The risk assessment system has improved accuracy and enabled tailored insurance policies, reducing both underwriting losses and customer dissatisfaction. The ability to create a streamlined claims management process enhances efficiency and reduces fraudulent claims, leading to faster settlements and increased customer trust. Consequently, optimizing underwriting decisions and pricing strategies improves reliability and profitability while maintaining competitive premiums.

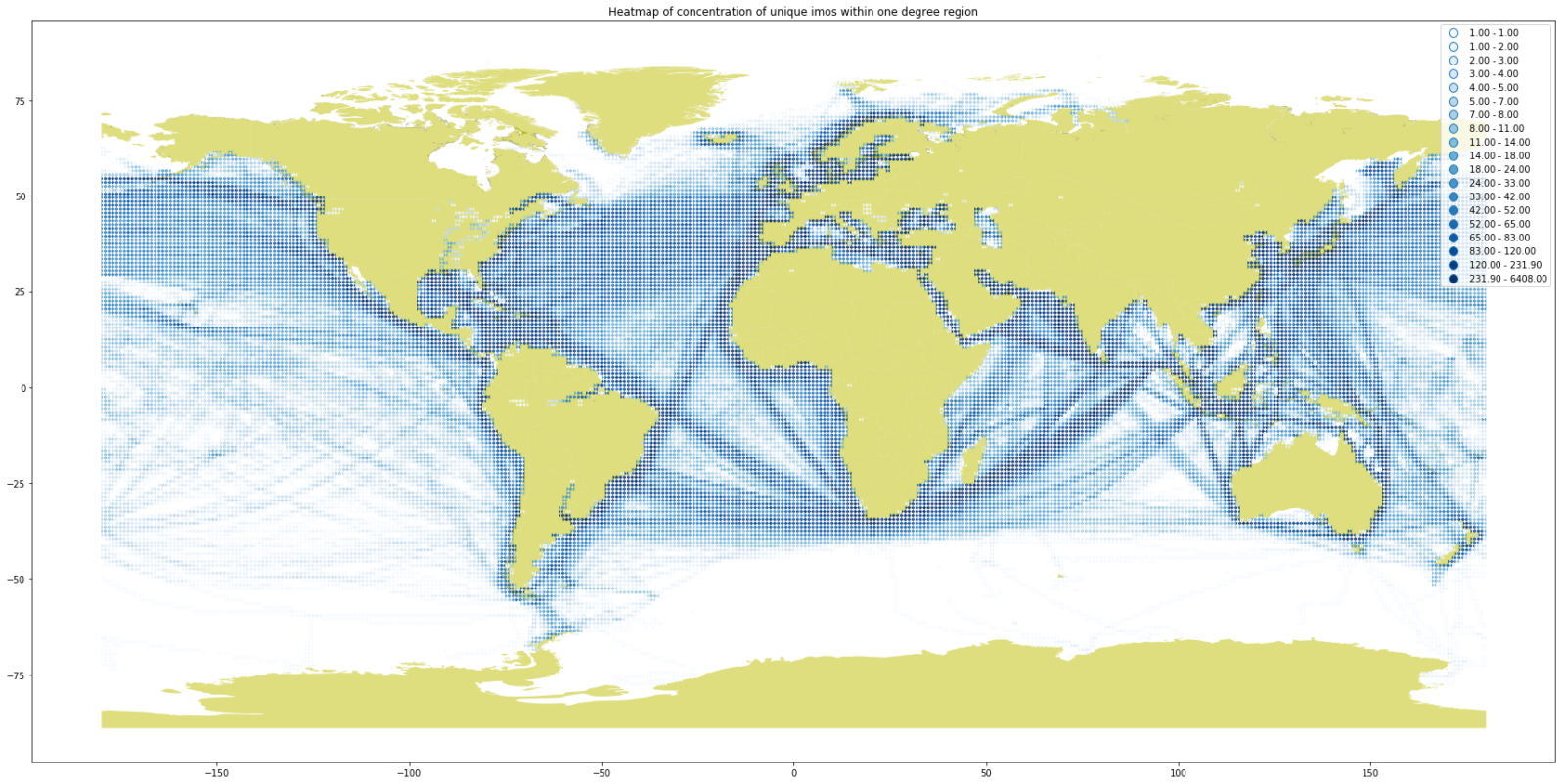

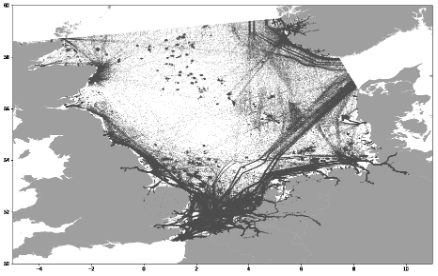

Density plot of global shipping activity at 1-degree resolution for a 1-year period

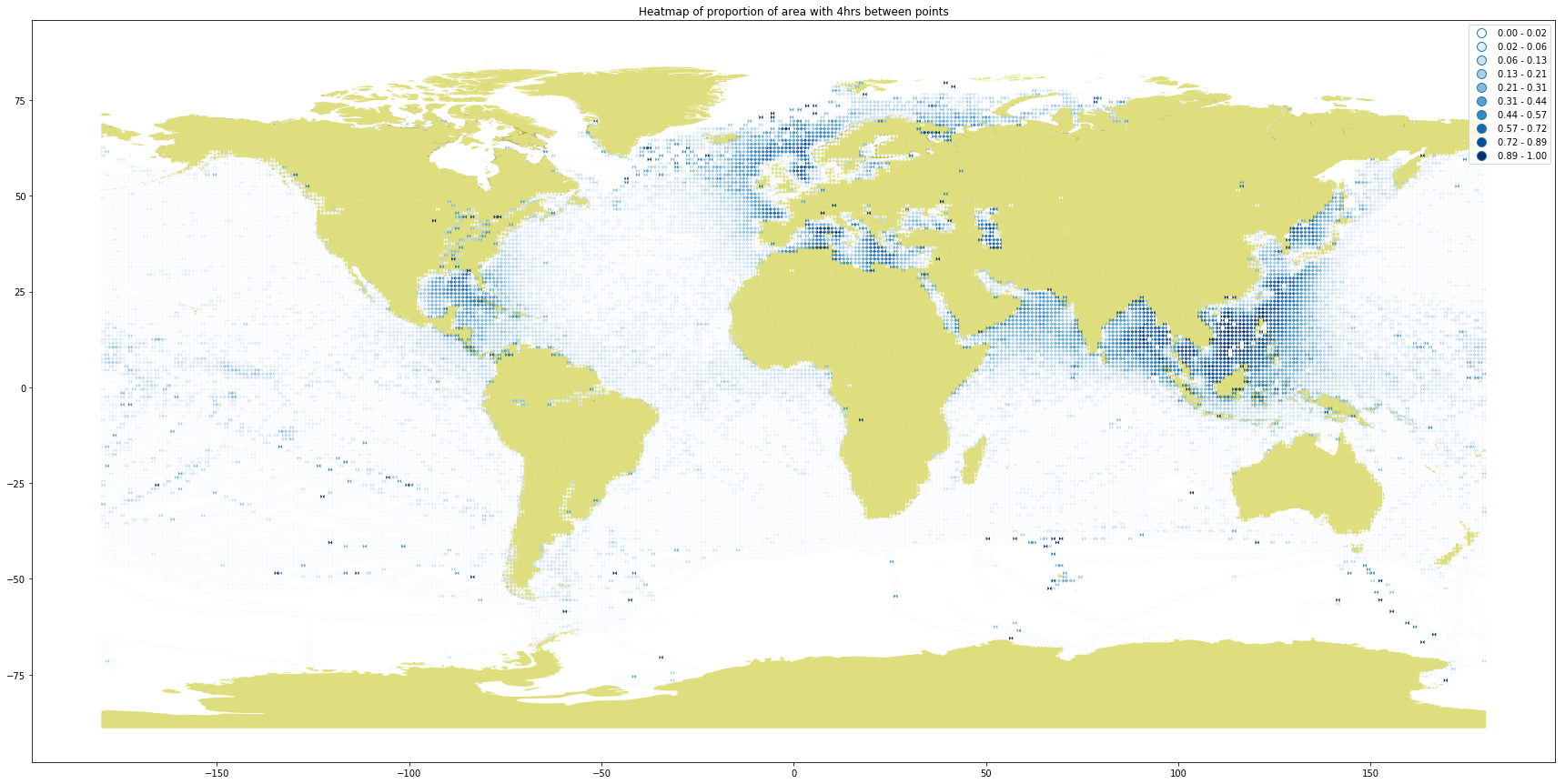

Observations of high data latency where AIS signal frequency is greater than 4 hours (excluding Spire data)

Low frequency of AIS positions observed in ocean areas of high shipping density causing reduced confidence in behavioural risk models

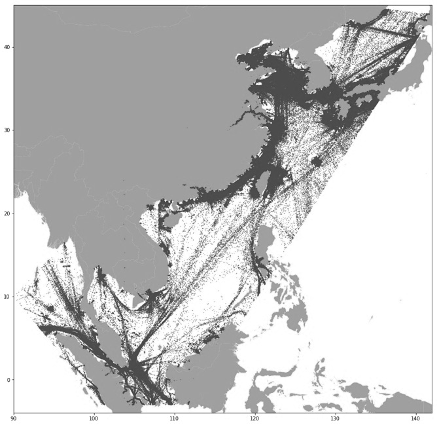

South China Sea data coverage: Original data

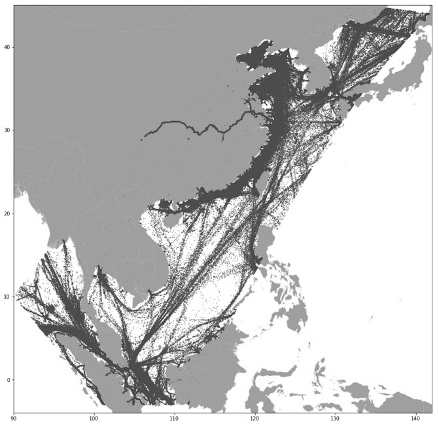

South China Sea data coverage: Spire data

North Sea data coverage: original data

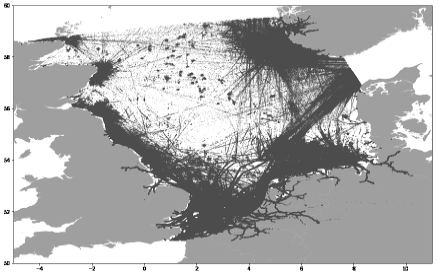

North Sea data coverage: Spire data

Integration with Spire Maritime

By integrating Spire Maritime’s AIS data into its system, Concirrus experienced remarkable enhancements. Firstly, the volume of AIS messages surged by an impressive 10 times in the North Sea, facilitating a significantly more comprehensive understanding of maritime activities in that region. Similarly, in the South China Sea, the message count witnessed a notable threefold increase, enabling Concirrus to gain deeper insights into the maritime traffic dynamics of this crucial area. Additionally, the integration led to a remarkable threefold reduction in signal loss during extended periods of four hours or more, ensuring a more consistent and reliable flow of data. Moreover, the incorporation of Spire AIS data uncovered previously unobserved maritime traffic in new locations, such as the upper Yangtze River. This expanded coverage empowers Concirrus to offer more comprehensive and accurate analysis and insights into global maritime activities.

Conclusion

The impact of Artificial Intelligence on the maritime insurance industry continues to grow. Through companies like Concirrus that build these technologies, the insurance industry can successfully improve risk assessment accuracy, claims management efficiency, underwriting decisions, and customer experience.

The collaboration of Concirrus with Spire is transforming traditional maritime insurance operations. Concirrus says it is enabling companies to build a competitive advantage – changing the way the insurance industry operates and leverage the true value of data.

Meet James Whitlam, the Product Director at Concirrus, revolutionizing Marine Insurance with AI. With a wealth of expertise in maritime data and as a Chartered Engineer and esteemed Member of the Royal Institution of Naval Architects, James drives Concirrus’ product & data strategy. He spearheads the development of SaaS products, making waves in the industry and transforming how marine risks are managed and insured.