Uncovering dark vessels with fusion technology

- Context

- Using tipping and cueing for stronger global maritime defense and security

- Understanding dark shipping detection methods with examples in action

- Cracking the code using Spire Maritime data and satellite imagery from URSA Space

- Ship-to-ship oil transfers: A closer look at unidentified vessels

- Impact on dark vessel detection changes since lifting US sanctions

Spire Maritime partnered with Ursa Space to explore how shipping behavior related to Venezuela’s oil exports changed in response to US sanctions.

Context

US sanctions were imposed on Venezuela’s oil exports in 2019. This set the stage for a widely chronicled practice by which Caracas employed a “dark fleet” of oil tankers intent on evading detection, allowing Venezuela to keep exports afloat and generate revenue for its economy.

When vessels turn off their transponders, significant gaps in maritime coverage are created impacting the Maritime Domain Awareness for industries such as Defense and Security, Commodities, Insurance, etc.

Collaborating with Ursa Space, Spire Maritime addresses these challenges.

The fusion of Spire Maritime’s AIS data and SAR imagery from Ursa’s virtual constellation allows the detection and tracking of ships that go ‘dark,’ (i.e., not broadcasting AIS signals). Going ‘dark’ does not always imply nefarious activity but may indicate that a vessel is hiding its location and identity to conceal illicit activities. By detecting and tracking dark vessels, Spire and Ursa are enhancing efforts to enforce international sanctions, prevent illegal activities, and track commodity cargoes.

Ursa Space is an analytics-as-a-service provider whose platform orchestrates satellite data and delivers analytic services at scale. In this scenario, we’ll focus on Ursa’s maritime solutions which can detect and identify vessels using SAR (synthetic aperture radar) imagery and AIS fusion. SAR is well suited as it can penetrate clouds and capture data day or night. This provides enhanced situational awareness at ports and seas, delivering reliable insights into the locations and identifications of vessels.

Spire Maritime has the largest proprietary satellite constellation, tracking over 600,000 vessels and 250,000 active vessels daily, providing the most comprehensive AIS data on the market dating back to 2010. Users can track vessels anywhere and at any time, enhancing situational awareness, and leverage precise and actionable data for well-informed decision-making, even in congested traffic areas.

Using tipping and cueing for stronger global maritime defense and security

Analyzing data from Spire Maritime and Ursa Space, we have chosen to showcase oil exports dynamics from Venezuela during US sanctions and from the short period since the sanctions were lifted in October 2023.

It is crucial to note that the United States retains the ability to reimpose sanctions, if Venezuela fails to abide by the terms of the agreement, underscoring the delicate nature of this new chapter in international relations. Sanctions can be reimposed if the government of President Nicolas Maduro fails to abide by the terms of an agreement signed last year for a fair presidential election. Whatever the outcome, Venezuela’s oil exports are a critical source of income.

Tipping and cueing employ satellite monitoring to detect and monitor large objects. Initially, a broad scan is conducted using a low-resolution satellite sensor, covering extensive areas in the ocean. Once a “tip” is generated, the information is transmitted to the Ursa team for “cueing.” Subsequently, the high-resolution sensor is activated to obtain detailed information about the identified object. We compare the scan with Spire Maritime’s AIS data to check the ship’s location. This helps us find and track ships that turn off their transponders.

Understanding dark shipping detection methods with examples in action

The analysis involved examining shipping channels both inbound and outbound from Venezuela over the period of two years. By pinpointing vessels that activated their AIS in the middle of the ocean, we were able to uncover unusual routes. There was heavy shipping traffic along the northern coast of South America, but unusually, AIS tracks are much lighter-than-expected along the routes into Venezuelan ports.

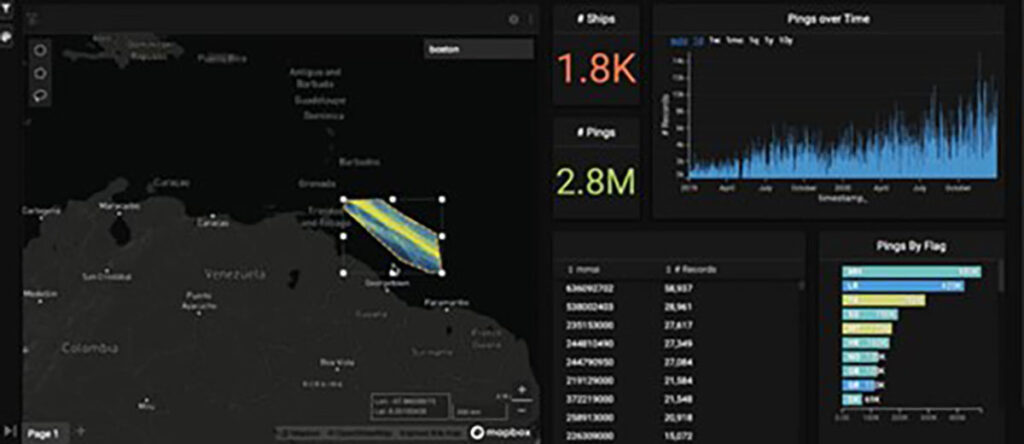

To examine the situation closer, the specific process involves taking a geographical slice by utilizing Spire Maritime’s Standard AIS data and applying a filter1 on the minutes since the last AIS contact (set to 24 hours), to identify ships that turned their AIS transponders on within the given geographic range but previously had their AIS off for an extended period. (See figure 1)

Figure 1: Geographical slice in the Venezuelan waters

A total of 23 ships were identified through this process, signaling potential anomalies in the shipping channel. One particular vessel drew attention during the analysis (an MMSI search indicates it as a known bad actor, sparking further interest).

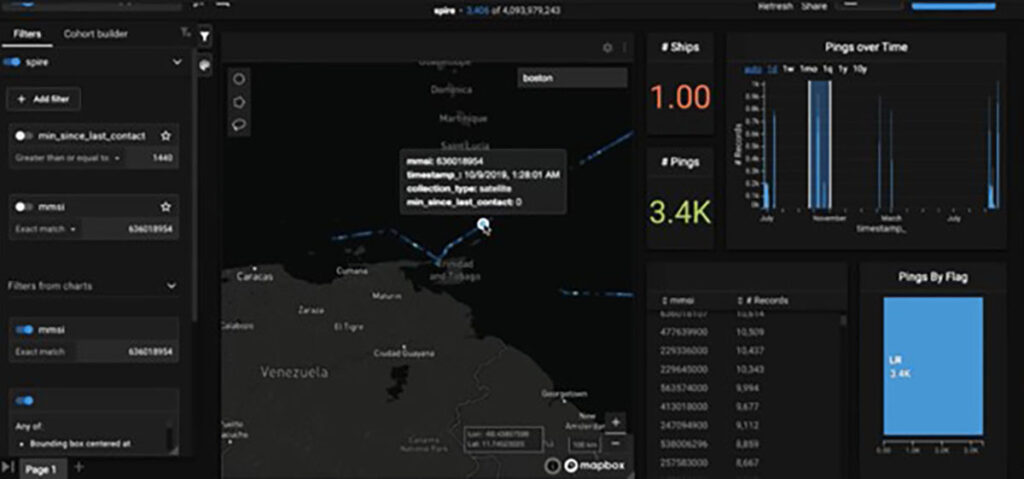

Zooming in on the selected vessel’s tracks: A suspicious event was identified, and the ship’s track abruptly turned on in the middle of the ocean. (See figure 2)

Figure 2: Selected vessel’s tracks dashboard

On the same day, the vessel entered Venezuelan waters, lost contact, and reappeared in a different location after a considerable gap (14,171 minutes later or around 10 days).

Figure 3: MMSI and time stamp

Cracking the code using Spire Maritime data and satellite imagery from URSA Space

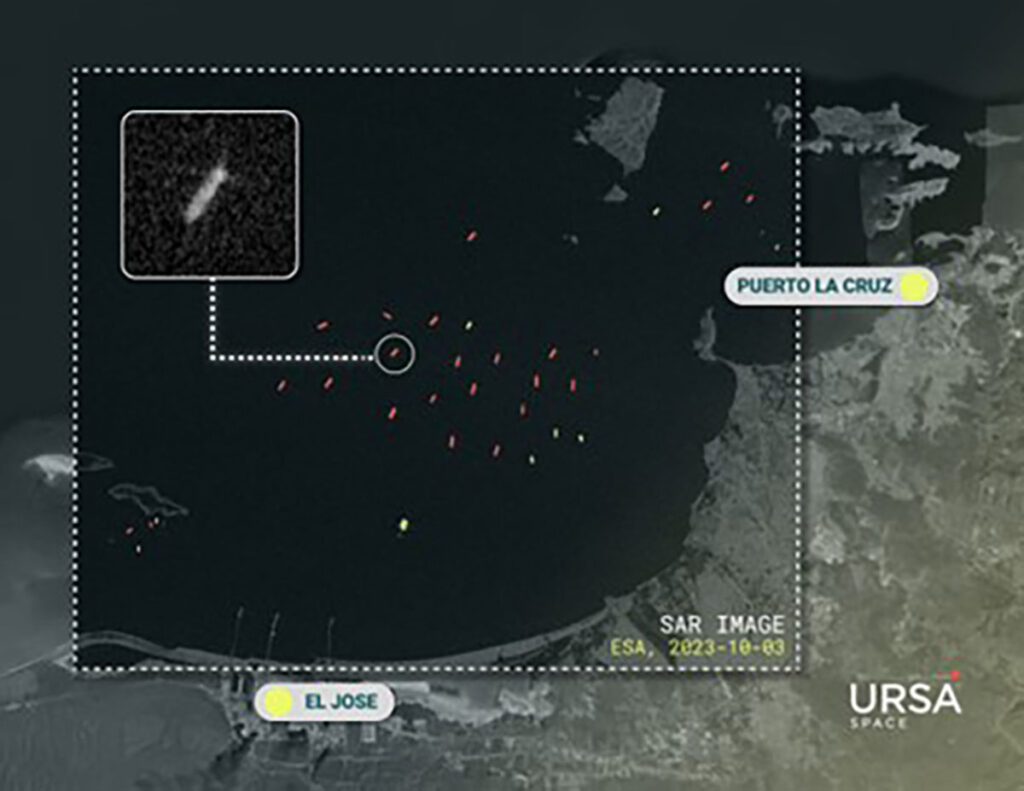

The image below shows vessels near the Venezuelan ports of El Jose and Puerto La Cruz identified using Spire Maritime AIS data. Ursa Space’s satellite images confirm the presence of vessels, including those with turned-off AIS transponders. There is a combination of ships with AIS turned on (green) and off (red).

Figure 4: El Jose & Puerto La Cruz Vessel detections – identified (green) and suspected dark vessels (red) – 2023

Figure 5: Puerto La Cruz Vessel detections – identified (blue) and suspected dark vessels (red) – 2019

Ship-to-ship oil transfers: A closer look at unidentified vessels

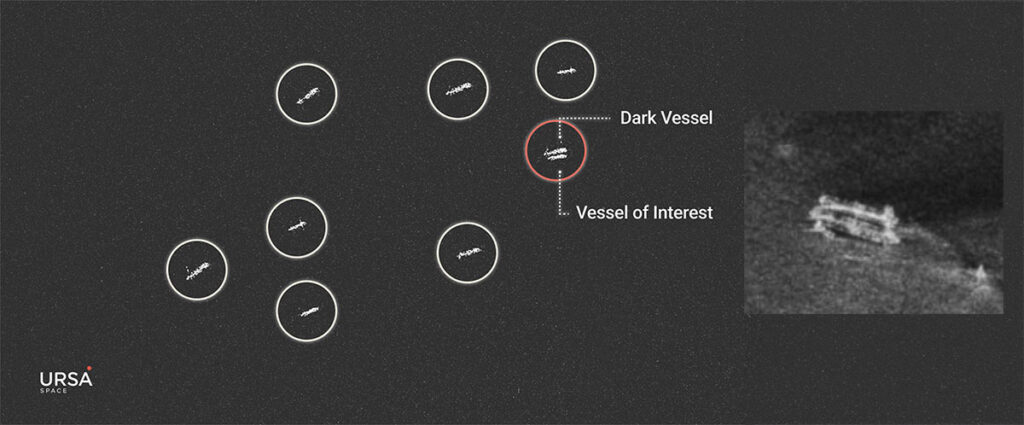

Once a tanker departs, then it’s a question of where it is headed, or more specifically where the cargo it’s carrying is going. This isn’t always straight-forward because ships will sometimes transfer their cargoes to other ships at sea.

Moreover, this event – called a ship-to-ship transfer – may occur while one or both of the ships go dark.(see Figure 6)

Figure 6: Active ship-to-ship oil transfer

Impact on dark vessel detection changes since lifting US sanctions

When the US imposed sanctions in 2019, Venezuela responded by trying to conceal the identities and whereabouts of oil tankers in an effort to maintain exports. These efforts continued until October 18, 2023, when the US eased sanctions on a conditional basis, and appear to have persisted afterwards.

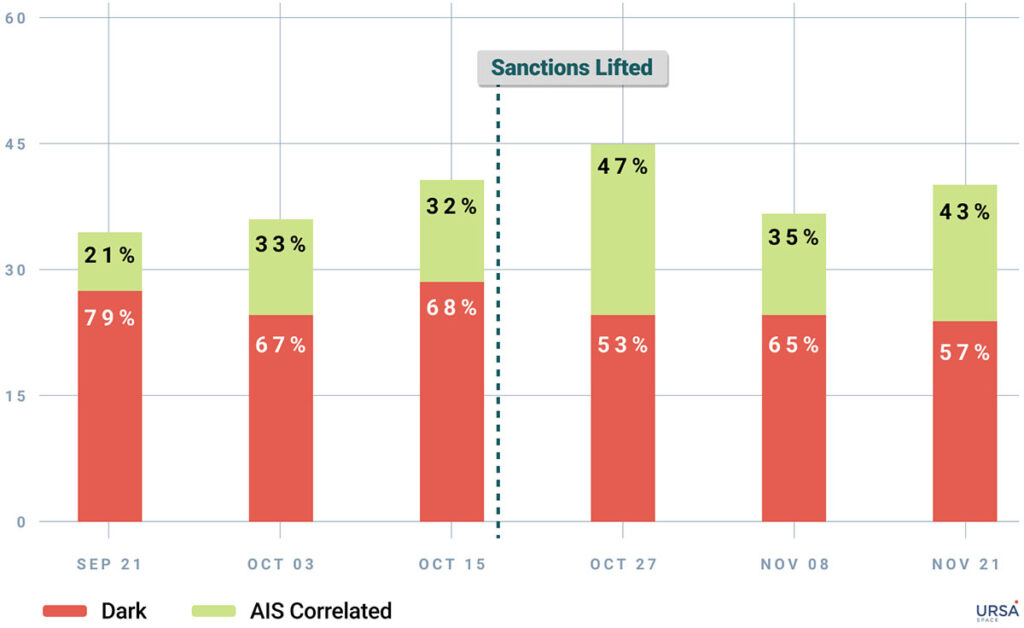

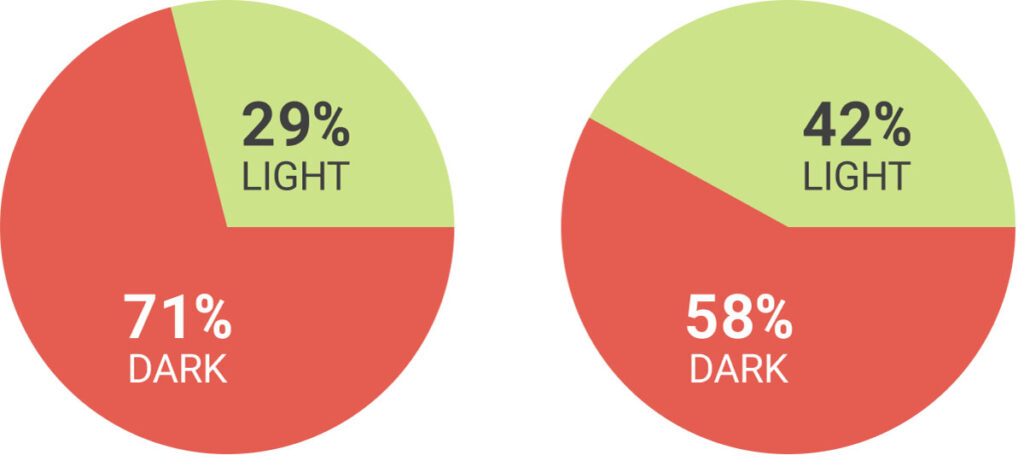

By examining AIS and SAR imagery, we found a decrease in the number of detected dark vessels in the weeks after sanctions were lifted, from 71% to 58%. Meanwhile, the percentage of AIS-correlated ships increased from 32% to 47%.

Close monitoring will continue in April to observe the impact if sanctions are reimposed.

Vessel detections in El Jose & Puerto La Cruz:

Dark ships decrease post-sanctions eased:

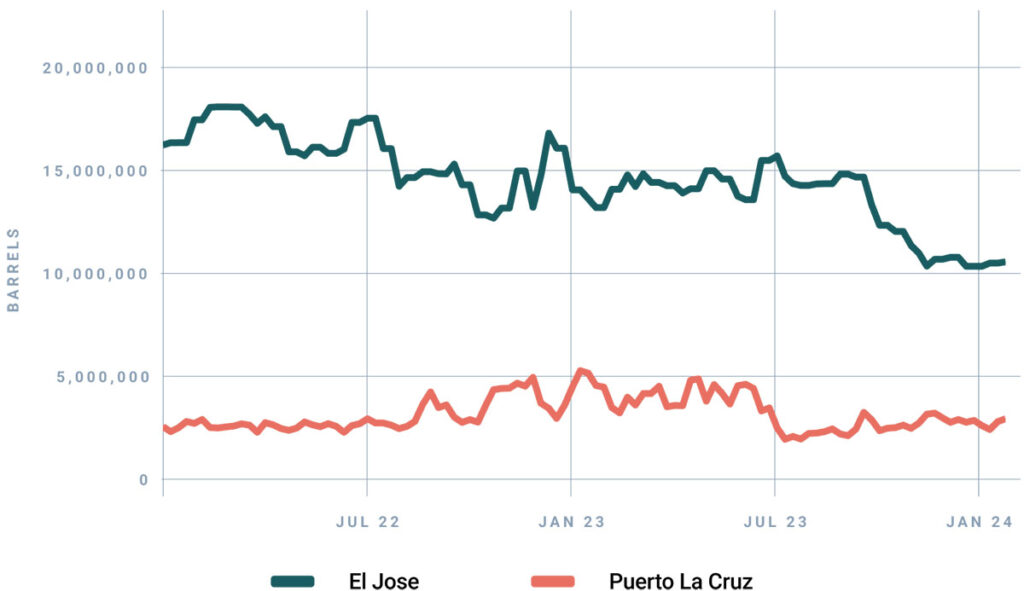

Oil inventories also help understand import and export volumes out of Venezuela.2

In Venezuela, the country’s main oil export terminal is El Jose. It is one of 11 Venezuelan storage locations Ursa Space monitors on a weekly basis. In October 2023, when sanctions were lifted, Ursa’s data for El Jose, and nearby Puerto La Cruz, both saw sharp declines in inventory levels which is consistent with reports of more exports, perhaps in anticipation of sanctions being lifted.

Venezuela Oil inventories in El Jose and Puerto La Cruz:

In summary, by the fusion of AIS data and SAR imagery, it is possible to tip and queue, to focus your tracking, saving you time and money.

Configure your AIS data solution

1 The dashboard features a filter allowing us to narrow down results based on the minutes since the ships’ last contact, as well as enabling us to define a specific geographical area for monitoring.

2 Ursa Space specializes in oil inventory measurements by applying proprietary algorithms to SAR imagery collected over more than 27,000 storage tanks every week. The coverage consists of 130 countries, including Venezuela.