How Spire and EarthDaily are redefining insurance and risk management

Spire Weather & Climate and EarthDaily have teamed up to transform how insurers assess and manage risk.

By integrating Spire’s real-time weather insights with EarthDaily’s geospatial analytics, this partnership enables proactive risk mitigation, helping insurers improve financial resilience and policyholder trust in an era of increasing climate volatility.

EarthDaily’s mission: Making geospatial data actionable

EarthDaily specializes in leveraging satellite constellations and geospatial analytics to deliver industry-specific solutions. The company operates across agriculture, mining, energy, and insurance, simplifying complex geospatial data for practical applications. With the acquisitions of Descartes Labs and Geosite, EarthDaily expanded its modeling and insurance capabilities, enhancing its ability to provide industry-leading insights.

EarthDaily’s insurance solutions focus on making geospatial data accessible to underwriters, claims teams, and risk managers. Its flagship platform, Ascend, integrates weather data and property analytics, enabling insurers to understand and act on climate-related risks with unprecedented precision.

“The core of our vision is to make geospatial data easier to use by tailoring it to specific industries. Geospatial data is inherently complex, and unless tools are designed to speak the language of their users, they’re too difficult to implement effectively,” Rachel Olney, EarthDaily Vice President of Insurance, said. “This is where Spire’s data plays a crucial role. In the insurance industry, we focus on interpreting slices of this data into actionable insights that insurance companies can use without being overwhelmed by the volume of information.”

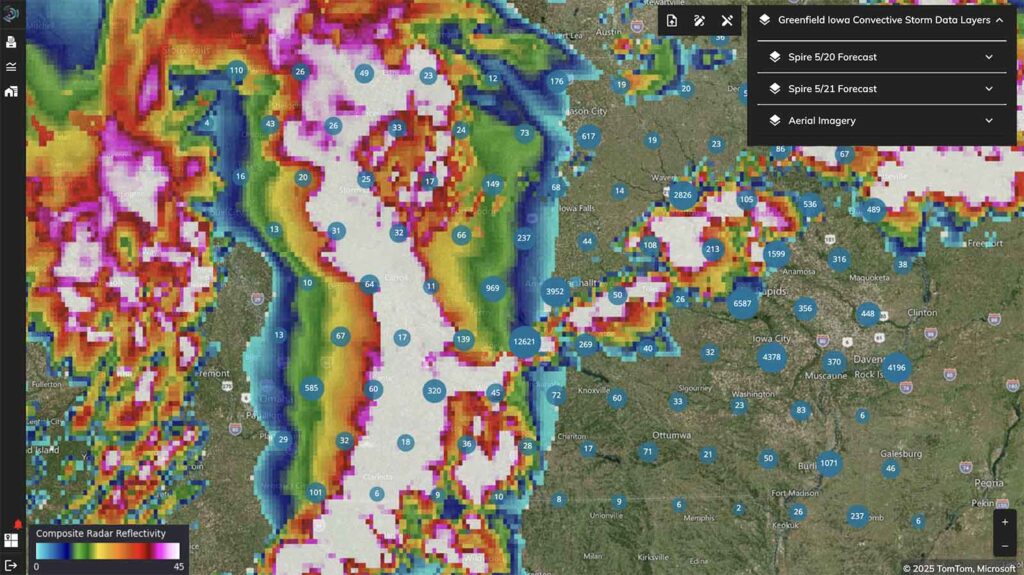

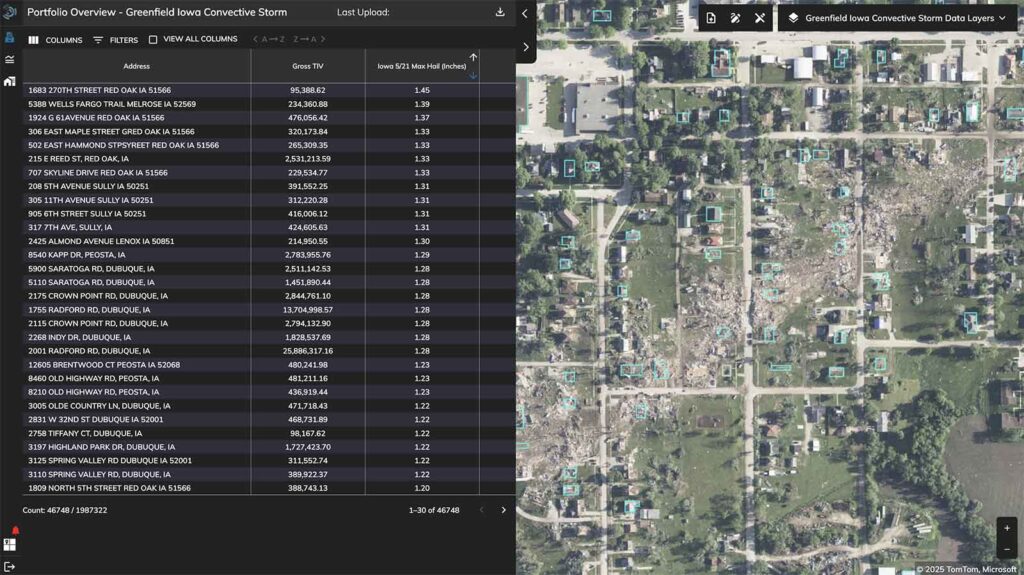

Spire’s data was used in Ascend to assess the total impact of a severe weather incident on carriers’ portfolios. Space-powered weather insights, portfolio data, and post-event imagery were combined to streamline the process from reserving to claims.

Shifting from reactive to proactive risk management

Traditional insurance models rely on post-disaster assessments, but Spire Weather & Climate and EarthDaily are changing this paradigm.

“The partnership is transformative. Insurance is a unique product because it’s based on theoretical risk analysis,” Olney explained. “By incorporating Spire’s granular weather data, we can provide insurers with a clearer understanding of risks, allowing them to create better products and respond proactively to events.”

“For example, weather events like hailstorms or high winds can be monitored in real-time. Insurers can then notify policyholders and arrange inspections or repairs before further damage occurs,” she added.

By incorporating Spire’s high-resolution weather data into EarthDaily’s Ascend platform, insurers can:

- Predict and mitigate risks before they escalate, such as issuing early warnings for hail, heavy rain, or high winds

- Alert policyholders to take protective measures, such as securing loose shingles before a storm intensifies

- Deploy adjusters preemptively to assess potential damage and expedite claims processing

“This proactive approach reduces claims costs and improves customer satisfaction. For instance, during a major storm in southern Australia, insurers used our platform to identify flooded properties and provide emergency funds to displaced residents before they even returned home. This level of responsiveness builds trust and mitigates losses,” Olney said.

Seamless integration of space-powered weather and geospatial data

EarthDaily’s integration of Spire Weather & Climate’s insights streamlines insurance workflows, eliminating the need for multiple platforms. By cross-referencing policy locations with real-time weather data, insurers can:

- Identify affected properties immediately after extreme weather events

- Estimate damages using wind speed, hail size, and flood depth data

- Prioritize claims adjustments for the most impacted areas

“Geospatial data plays a critical role throughout the insurance lifecycle. Initially, insurers use historical data to price risk and develop new products,” Olney said. “For example, they analyze past weather events to predict future risks and create climate-adjusted models. Once a product is launched, geospatial data helps insurers manage risk by tracking policy locations and monitoring weather events in real-time.”

Users can filter their portfolios to identify policies affected by specific weather events, such as high winds or heavy rainfall. This allows insurers to prioritize claims adjustments and estimate potential losses more accurately.

Moreover, APIs bring EarthDaily’s geospatial data and Spire’s weather data directly into insurers’ existing systems, ensuring seamless, real-time access to crucial information. Claims teams no longer need to toggle between platforms; instead, they receive automated alerts and detailed reports directly within business process management systems (BPMS) or policy admin systems.

Climate change and the future of insurance

The increasing frequency and severity of extreme weather events—wildfires, droughts, floods, and hurricanes—has rendered traditional insurance models unsustainable. Spire and EarthDaily are at the forefront of change, providing insurers with climate-adjusted risk models to:

- Improve underwriting precision by incorporating real-time climate-adjusted forward-looking models in addition to historical weather insights

- Enhance resilience by allowing insurers to anticipate and respond to evolving climate threats through more precise risk selection and management

- Reduce losses by leveraging proactive risk mitigation strategies

EarthDaily and Spire envision a future where insurers are not just reactive responders but proactive risk managers. Imagine an insurance company automatically dispatching a contractor to reinforce a home’s roof before a storm arrives, preventing costly damage and policyholder distress.

A smarter, more resilient insurance industry

As the insurance sector grapples with increasing climate-driven risks, partnerships like that of Spire and EarthDaily offer a glimpse into a more resilient future. By merging geospatial intelligence with hyper-accurate, space-powered weather data, they empower insurers to navigate uncertainty, minimize losses, and build stronger relationships with policyholders.

“Our ultimate goal is to make geospatial data so intuitive and accessible that users don’t even realize they’re interacting with it,” Olney said. “This vision of proactive risk management benefits everyone involved by reducing losses and improving resilience. By embedding geospatial insights into everyday operations, we can help industries adapt to the challenges of climate change and build a more resilient future.”

This collaboration showcases the transformative power of technology, paving the way for smarter insurance solutions. The dream of seamless, proactive risk management is no longer a distant possibility—it is becoming a reality.

Written by

Written by