More than Planning Fuel Efficiency: Weather Data is Tapped for Insurance Claims

Millions of dollars of cargo continues to pile up on the ocean floor as more containers topple off of ships mid-transport. Weather data is becoming a key element in the claims process.

The push for faster shipping, rapid e-commerce growth, and larger vessels have resulted in an alarming amount of consumer goods being knocked overboard, mostly in the Pacific Ocean. Why is this happening and what are the long term effects of this sinking trend? The answers vary depending on who you ask, but a stressed supply chain, climate change, and increased consumer demand seem to have stretched the shipping industry to its limits.

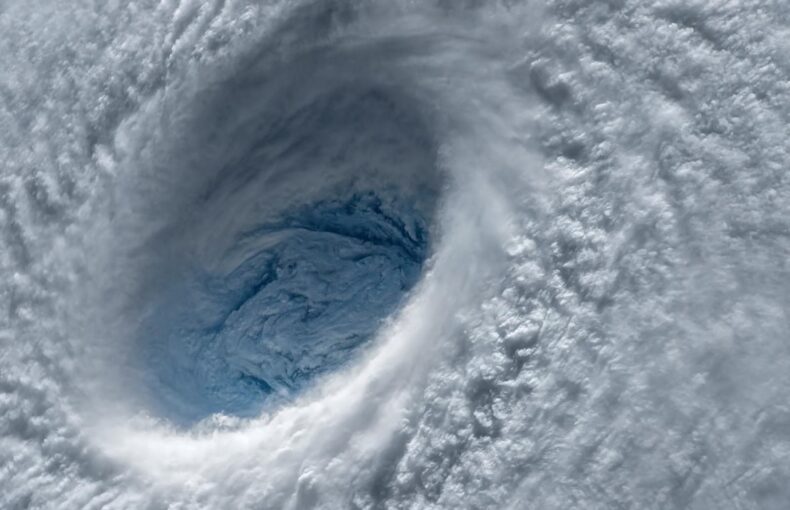

According to Bloomberg it’s the biggest spike in lost containers in seven years and the count continues to grow. More than 1,000 boxes have fallen overboard in 2021 and the impact of these losses affect supply chains, U.S. retailers, and manufacturers. Why the sudden rise in container losses? Many believe it’s a combination of unpredictable weather brought on by climate change, the large size of container vessels, tight scheduling, and a phenomenon called parametric rolling. Parametric rolling can happen when waves hit a ship’s bow at an angle, rather than head-on. The ship goes into a rolling motion in sync with the waves which, combined with the ship’s normal pitching as it steams ahead, can displace cargo. The higher you stack the boxes on deck, the larger the forces they are subjected to when the vessel moves in waves.

COVID too plays a role in these losses. E-commerce usage has soared during the pandemic and created a massive shortage in space on containerships. Containership operators are tasked with adhering to an extremely tight voyage schedule and when you combine ships packed to the brim with huge containers, short loading and turnaround times, and unpredictable weather, unplanned events seem to follow.

As the losses grow, Insurance companies turn to data

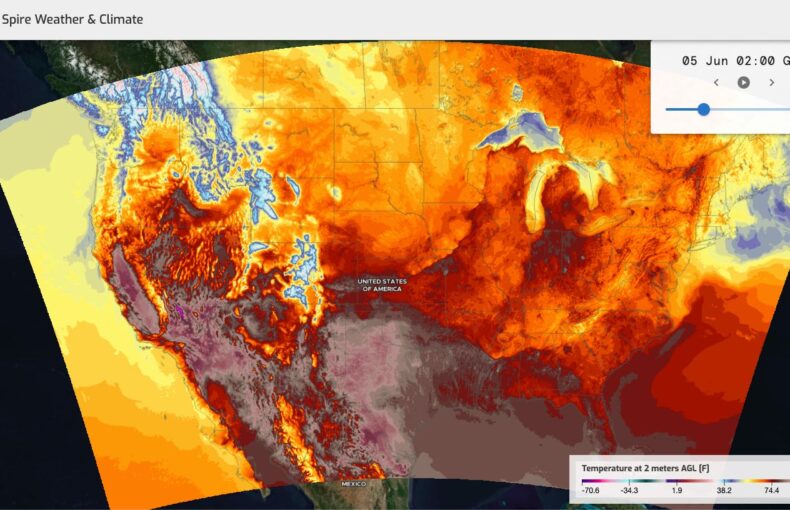

Insurance and claims companies have taken notice of these incidents which are increasing in number. Weather has always been a factor analyzed by shipping companies, but now that vessels are fuller and more in demand, weather data is often combined with routing data and AIS data, all of which are useful in the claims process. Historical data for a period of time and a specific area are becoming more and more common in the claims process. Even small incidents can be complicated when determining liability. Purchasing data is a small investment when compared to the payout of a claim. Weather has always been useful for fuel efficiency planning and now is used for claims and route planning as well.

Two-fold use of data

Weather forecast data has moved beyond its use for optimizing operations and preventing incidents. As the overall digital transformation in maritime progresses, maritime companies have accepted that they are not insulated from competition outside of their industry.

Data, and combining different types of data, is becoming essential to leading optimized operations that run safely. Shipping companies generally prioritize fuel efficiency and emissions control, but as container companies become increasingly schedule-driven, bulk carriers maintain more leeway in their schedules. Container shipping companies have to manage both. Fleet operation centers focus on a particular trade or service and need transparency when looking at what is happening in the trade lanes where they work. Forecast and historical data focused on specific regions is particularly beneficial for these companies. Bulk and tanker operators look at a global trade and scheduling as they receive cargo and select the best destination based on demand so their data needs to help build a detailed plan based on forecast information.

2020 delivered multiple challenges for container shipping

The container shipping industry faced many challenges last year as vendors and goods distributors leaned heavily on these massive ships to deliver goods quickly along popular shipping routes from China to the United States, Europe, and the Middle East. Working around the clock to keep these vessels moving, the weather delivered massive challenges with a record-setting 2020 storm season, cited as the cause for many of the container losses at sea.

The size and configuration of the ships makes a difference

Containers can be stacked five or six high on container ships and given these ships’ longer than average dimensions, tolerating rolling waves and high winds can result in containers going overboard. Bad weather and high winds have proven to be a lethal combination to vessels loaded to the brim with cargo. Nearly 3,000 containers have been lost at sea just in the Pacific Ocean over the last three months and according to the World Shipping Council that number continues to grow.

Data can help predict developing sea conditions

Marine forecast data can help predict ocean conditions at sea and plan safer operations for marine shipping enterprises. Here’s a look at a few of the lost container incidents that recently occurred:

Maersk Eindhoven – Feb 17, 260 containers lost

Our data maps the course of the Maersk Eindhoven in February before it lost 260 containers after getting caught in bad weather and high waves in January 2021. Here we see the north flowing Kuroshio Current as it collides with the cold subarctic Oyashio Current off the coast of Japan. Together, these form the North Pacific Current, also referred to as the North Pacific Drift, which flows from east to west towards North America. Eventually it splits again, with the Alaska Current flowing northward and the California Current going south. Cargo that is lost off the coast of Japan and caught in these currents could therefore end up traveling across the entire Pacific Ocean.

The One Apus lost 1,800 containers in November amid high winds, ranking as the highest cargo loss since 2013 when the MOL Comfort sank along with its cargo totalling 4,293 containers in the Indian Ocean. This loss could cost more than $220 Million in insurance and repairs.

Maersk Essen – Jan 16, 770 containers lost

The Maersk Essen lost an estimated 770 containers in January during its voyage from China, to Los Angeles. Spire data captured wave height and shows the course changes happening when the vessel is in the middle of 6 – 12 meter high waves.

Unpredictable weather, human error, large vessels, a workforce strained by the pandemic, and the boon in e-commerce exhausted many in the shipping industry. Data is an easy to use tool to help predict weather patterns and schedule arrival times with accuracy so planning can be determined before a vessel leaves port. Contact us for more information about our customized data solutions and historical data sets.

Written by

Written by