What could be the impacts of Ukraine’s invasion on maritime trade?

We look at patterns in trade flows to predict what consequences might follow, after the invasion of Ukraine by Russia.

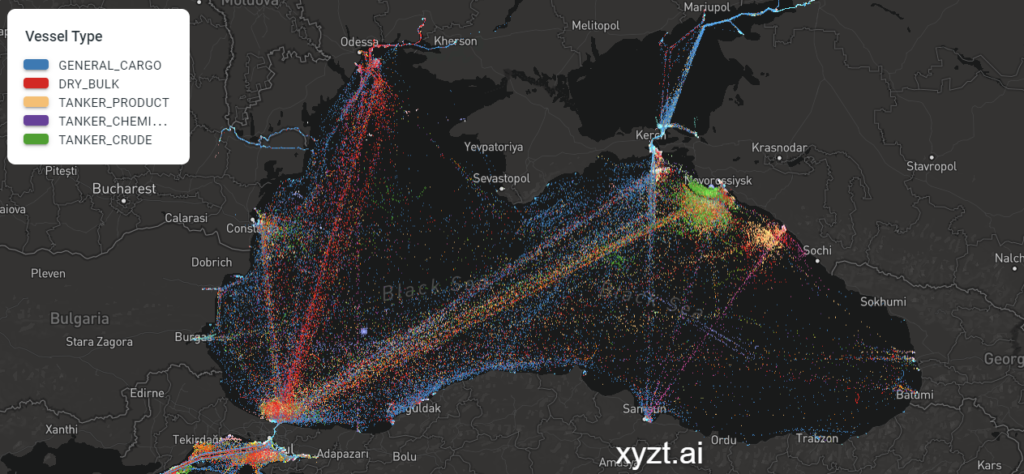

Global maritime trade is a complex interconnected ecosystem that is already under due stress with the COVID-19 pandemic and shortage of manpower. With the additional impact of the war that Russia is raging over Ukraine, you can only expect further disruptions. . The invasion of Ukraine by Russia on February 24, 2022 has led to an international outcry with the world reinforcing immediate economic measures, such as the suspension of commercial shipping in ports by the Ukraine’s military or the closure of maritime routes in the Azov sea by Russia. The Russian sanctions are also expected to impact availability and pricing to markets, resulting in a possible shift of maritime trade patterns in response to these events.

This is an area where we at Spire hope to make a difference in our own way by rapidly identifying changes in maritime trade patterns. Our satellite constellation is set up to monitor global maritime shipping in real-time combined with our Vessel Characteristics database that details each ship (registration, history, type, capacity, etc.) and this is how we can provide clues on what is being carried and by whom.

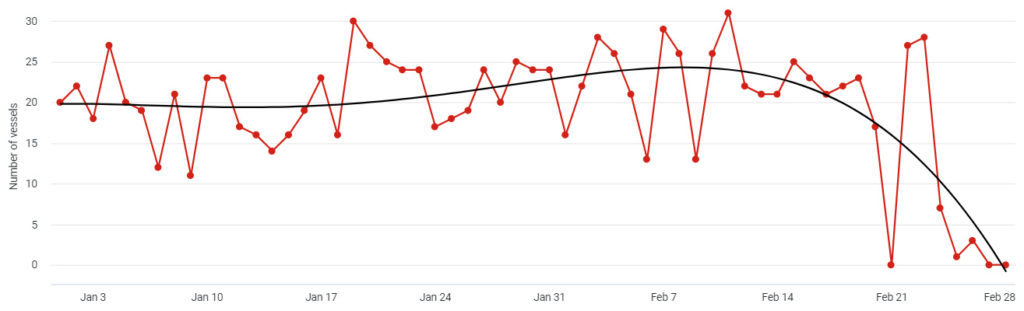

Our data shows the break in commercial port activity in Ukraine since the invasion on February 24, 2022.

Daily number of arrival of commercial vessels in Ukraine ports in 2022 (with a polynomial trend in black)

To better understand the potential impacts of this abrupt stop in port activity, let’s first have a better understanding of maritime shipping involving Ukraine. With ports located in the Black Sea, Ukraine is among the top five grain exporters worldwide. Ukraine is also largely involved in the production and export of metals such as nickel, copper, iron and other essential raw materials that range from neon, palladium and platinum that are especially critical for microchip production.

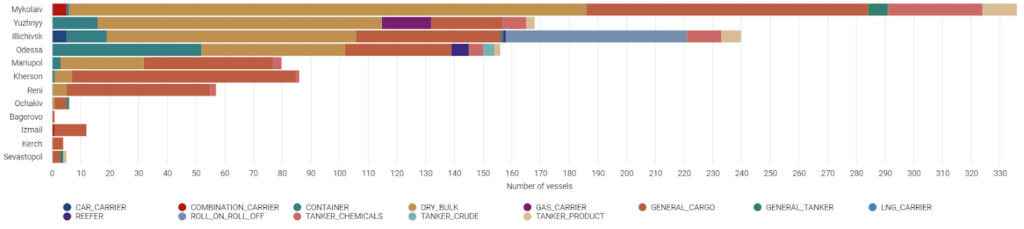

Commercial vessels that arrive in Ukrainian ports mainly include dry bulk (40%), general cargo (35%), tankers (10%), containers (7.6%) and Ro-Ro vessels (5.5%). The most important Ukrainian ports are Mykolayiv (29% of commercial vessel arrivals since January 2022), Chernomorsk (Illichivsk, 21%), Yuzhnyy (15%) and Odessa (14%).

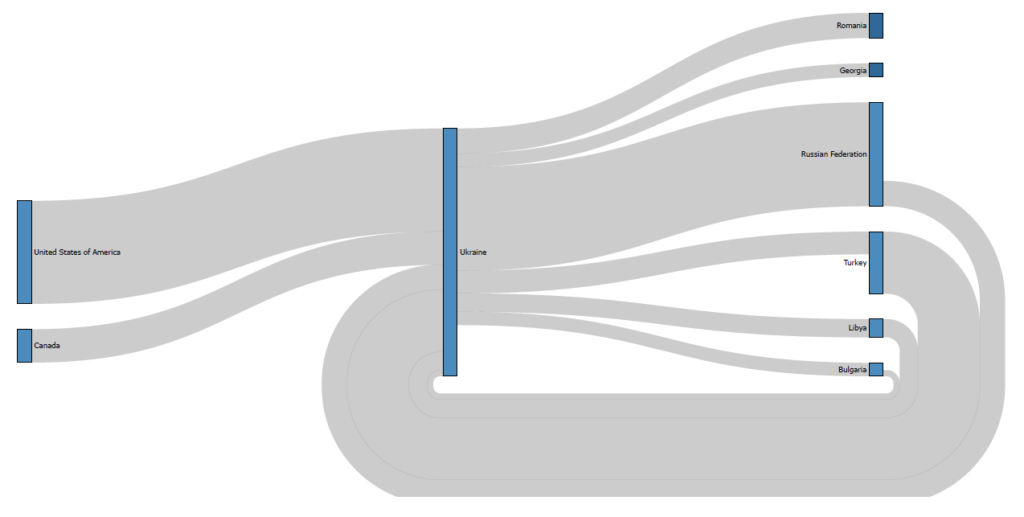

Now, by assuming that vessels leaving ports correspond to exports, and that vessels arriving in ports correspond to imports, we can derive maritime trade flows between countries commercially involved with Ukraine, from a retrospective analysis from June 2021 to February 2022.

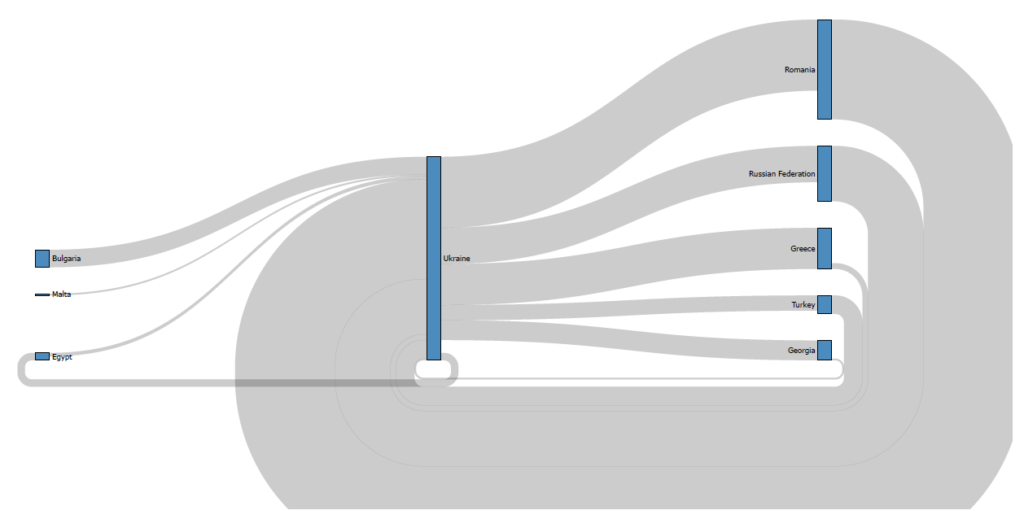

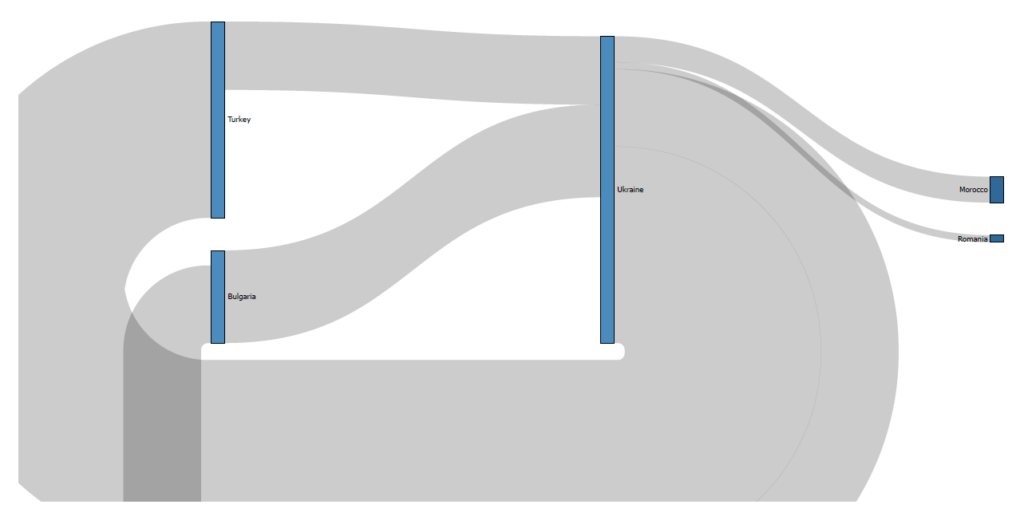

Dry bulk trade flows

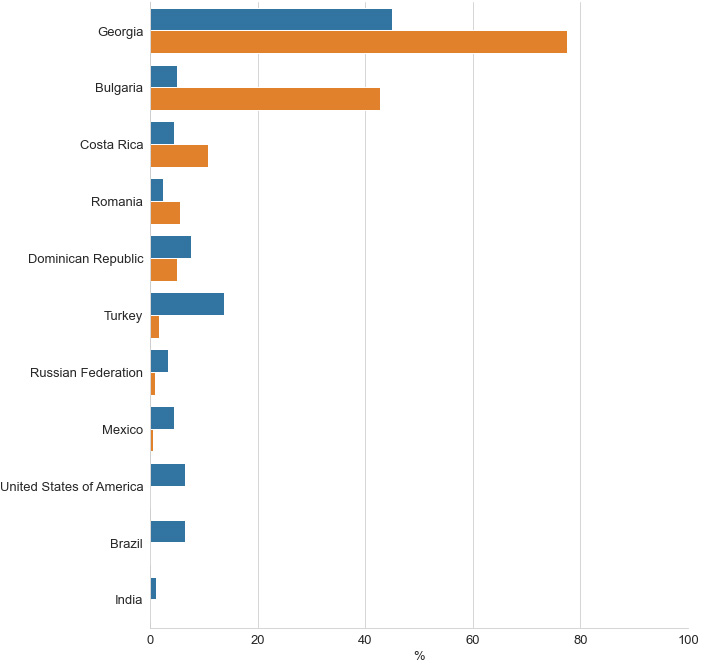

We identified 16 countries that share trading ties with Ukraine for dry bulks. The flowchart shows that Ukraine maintains close partnerships with countries such as Turkey, Bulgaria or Georgia, where Ukraine both imports and exports.

Dry bulks trade flows with Ukraine between June 2021 and February 2022. The left side corresponds to Ukraine imports, and the right side to Ukraine exports. The flow width is proportional to the total grain cubic capacity of vessels, by taking into account both imports & exports).

With a deeper analysis of the data, we have observed the following:

- Georgia is the first destination of Ukrainian dry bulk exports. This country is highly dependent on Ukraine: 78% of Georgia dry bulk imports arrive from Ukraine.

- Bulgaria is also very dependent on Ukraine: 43% of Bulgarian dry bulk imports come from Ukraine, and 80% of Bulgaria dry bulk exports go to Ukraine.

- Turkey is the second destination of Ukrainian dry bulk exports yet has a lower degree of dependency as only 1.7% of Turkey dry bulk imports come from Ukraine. The dependency would be more significant on the other side, as Turkey represents 30% of Ukraine dry bulk imports.

General cargo trade flows

The flowchart shows there are two major partners for Ukrainian general cargo imports: Turkey (37% of Ukrainian general cargo imports) and USA (33% of Ukrainian general cargo imports). The first destination of Ukrainian general cargo exports is Russia (41% of Ukraine general cargo exports). Among the countries importing from Ukraine, Bulgaria has the strongest dependency to Ukraine, as 11% of Bulgaria general cargo imports come from here.

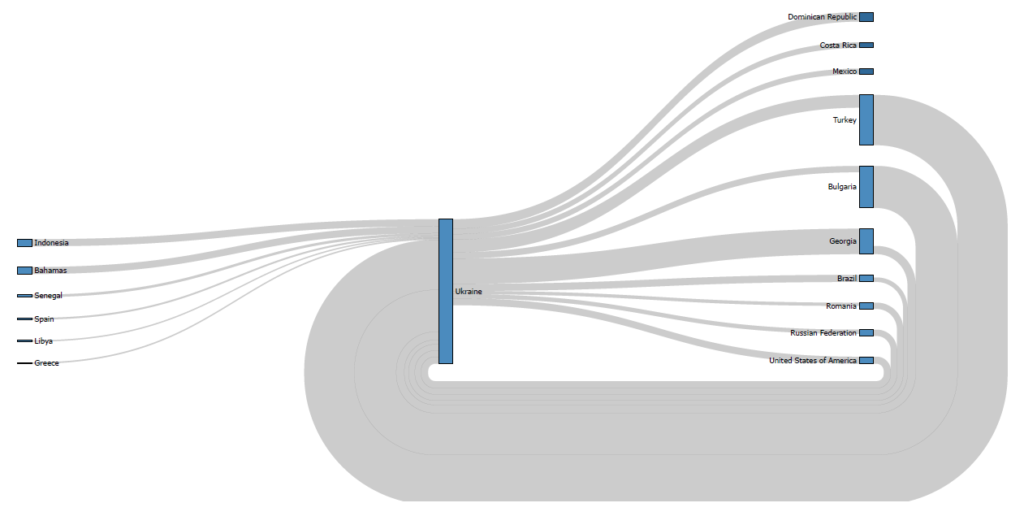

Container trade flows

8 countries are directly involved with Ukraine for container shipping. The flowchart shows that Romania is the first partner of Ukraine:

- 60% of Romanian container exports go to Ukraine whilst 54% of Romania container imports come from Ukraine, indicating Romania’s strong reliance on Ukraine.

- 43% of Ukraine container imports come from Romania, and 34% of Ukraine container exports go to Romania.

Note that Georgia container imports are highly dependent on Ukraine, as 69% of these imports come from Ukraine.

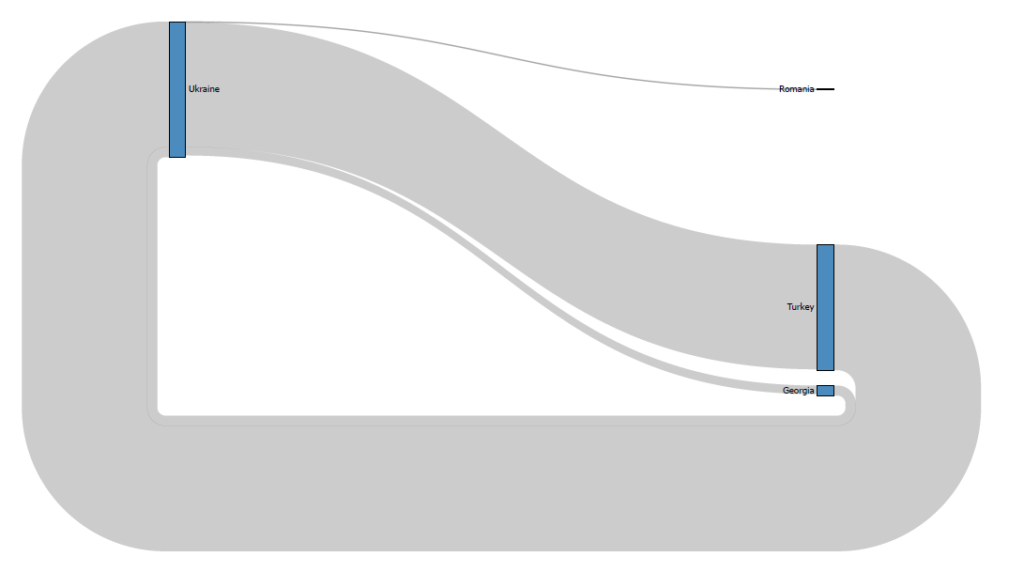

Roll-on/Roll-off trade flows

Ukraine partners almost exclusively with Turkey for RoRo shipping: Turkey represents 93% of Ukraine RoRo exports, and 93% of Ukraine RoRo imports come from Turkey. However, Ukraine is not the only partner of Turkey for RoRo shipping, as Ukraine represents 18% of Turkey RoRo exports, and 16% of Turkey RoRo imports come from Ukraine.

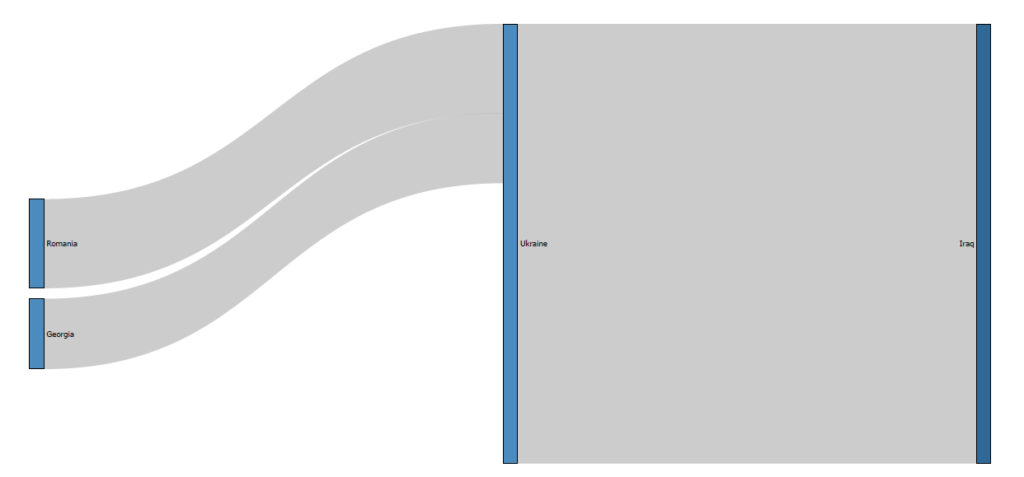

Chemical tanker trade flows

Ukraine partners with three countries for chemical tanker shipping:

- Iraq: 100% of Ukraine chemical tanker exports. Note that 56% of Iraqi chemical tanker imports come from Ukraine, indicative of a very strong partnership between them.

- Romania: 55% of Ukraine chemical tanker imports.

- Georgia: 45% of Ukraine chemical tanker imports.

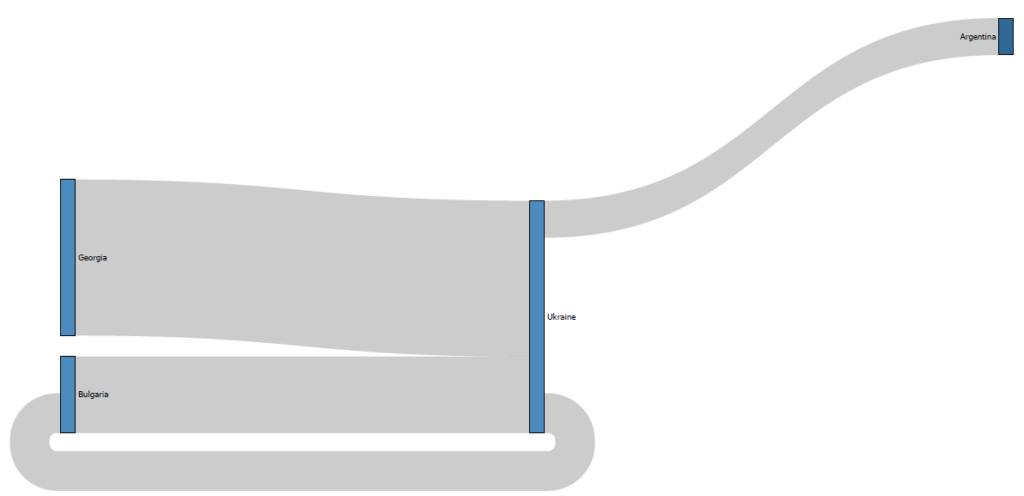

Product tanker trade flows

Ukraine partners with three countries for product tanker shipping:

- Argentina: 50% of Ukraine product tanker exports. Note that Argentina has a low dependency towards Ukraine imports, as only 3% of Argentina product tanker imports come from Ukraine.

- Georgia: 50% of Ukraine product tanker imports, 68% of Ukraine product tanker imports. 50% of Georgia product tanker exports go to Ukraine.

- Bulgaria: 50% of Ukraine product tanker exports, 32% of Ukraine product tanker imports. All Bulgaria product tanker exports go to Ukraine.

LPG trade flows

Ukraine partners with two countries for LPG shipping:

- Turkey: 64% of Ukraine LPG exports, 43% of Ukraine LPG imports. Note that Turkey has quite a low dependency towards Ukrainian imports, as only 9% of Turkey LPG imports come from Ukraine.

- Bulgaria: 25% of Ukraine LPG exports, 57% of Ukraine LPG imports. 69% of Bulgaria LPG exports go to Ukraine, and 47% of Bulgaria LPG imports come from Ukraine, which shows a significant dependency towards Ukraine.

These patterns in trade flows are representative of the commercial situation before the invasion of 24 February 2022. We identified several examples of countries having a strong maritime trade dependency towards Ukraine. Now, with the suspension of commercial shipping in Ukraine ports, importers will struggle to replace supplies, and maritime trade flows will undoubtedly shift to adapt to this supply-chain disruption.

UNICEF

Our thoughts continue to be with the people of Ukraine. Please donate to UNICEF. UNICEF is included in CharityWatch’s list of Top-Rated Charities, with every dollar spent, 88 cents goes toward helping children.

Written by

Written by