Port of Los Angeles: Data shows ships stood still for 5 days in November 2020

Interested in this FREE data set?

Shipping companies are tackling a mountain of challenges this holiday season to ensure on-time package arrivals whilst navigating COVID-19 protocols, a record-breaking storm season, and political uncertainties. With holiday season shipping in full swing, the Port of Los Angeles has been reporting heavy delays and challenges. A closer look at our port and anchorage analytics confirms there have been significant disruptions, which are likely to have had a costly impact on the whole supply chain.

The Port of Los Angeles

As the busiest port in the US, the Port of Los Angeles set a new record last month as imports surged, up 27.3% on the same month last year. The Port of Los Angeles handles more Chinese imports than any other port in the world and was managing a lower than average cargo pace due to the COVID pandemic and shutdowns earlier this year. The Port of Long Beach is also showing similar event patterns.

Our data shows a consistent flow of ships into the busy port and an increase in time spent at port during the month of November. The busier a port is, the longer time spent unloading and berthing. This indicates a busy holiday season and a high volume of imports at the port.

Container ships count – Port of Los Angeles

The Port of Los Angeles was earmarked as a contributor to the trade imbalance that led to a container shortage in Asia. Carriers are now directed to reposition empty containers onboard vessels and send them back to Asia as quickly as possible. Not only are we seeing spikes in the number of containers at port, but also duration at port exceeding 120 hours (5 days) in October and November. Ships remaining in port that long has a costly ripple effect on ports and supply chains. The chart below also shows the median duration at ports at a minimum of 60 hours and fluctuating constantly between Aug 2020 and Nov 2020.

Median duration in port – Port of Los Angeles

Anchorage activity around the Port of Los Angeles

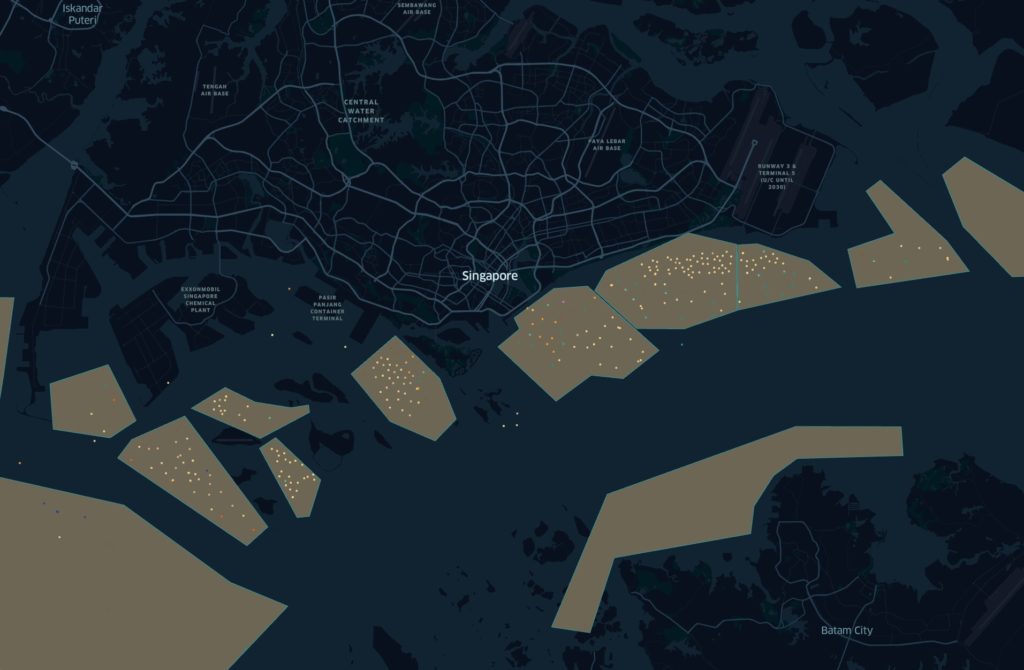

The anchorages are a set of polygons researched and drawn where vessels are observed to stop/anchor outside ports. Spire can track ships entering and exiting anchorage, combining Spire’s own anchorage polygons cross-referenced against official port anchorage areas. Often when ports are experiencing heavy traffic, disruptions can also be observed in anchorage.

Example: Anchorage areas and Vessels in Singapore

We took a closer look at the number of ships in anchorage around those peak periods. The charts below clearly show ship traffic is equally building up in anchorage and ships are remaining anchored, neither loading or unloading, for several days. Money is always lost when a ship is sitting still.

Anchorage – Container ships count – Port of Los Angeles

The week of 2-8 November is interesting to take a closer look at with the highest durations recorded during that period. The median duration at the port was over 120 hours (5 days), and 14 ships were sitting in anchorage for a median duration of 37 hours. However, the count of ships at the port was far from the highest recorded during that period. This could potentially suggest that the heavy anchorage traffic was having an impact on the ability for ships to enter/exit the port.

Anchorage – Median duration in hours – Port of Los Angeles

A positive outlook for PortMiami

Where the busiest ports like Port of Los Angeles and Long Beach are experiencing heavy disruptions and costly delays, other lesser-known cargo ports are being tapped to support the heavy trade flows.

PortMiami is known as the cruise capital of the world and with the cruise industry weathering shutdowns and slowdowns due to COVID, the port has been focusing more on cargo this year.

PortMiami set a new record for its cargo operations in October, with more than 107,000 TEUs handled in the port, representing an increase of 1.5%. PortMiami completed infrastructure improvements in early 2020 valued at more than $1bn, which included deepening the port’s channel to better accommodate larger vessels and acquiring new cranes.

Container ships count – PortMiami

Median duration in port – PortMiami

The infrastructure investments coupled with the busy holiday shipping season proved a potent solution to the slow down in shipping in the first quarter of 2020. Our data shows a pick-up in the number of container ships at the port and the median time spent at port is also consistently under 24 hours since September, with a slight increase in October and November. PortMiami seems to be handling cargo quite well, hitting records and showing very few signs of disruptions.

What’s Next?

Look for port traffic to continue to increase as the holiday season moves forward and shippers are tasked with providing products to maintain supply chain stability as the world continues to navigate the COVID-19 pandemic. The containership shortage continues, US exports continue to remain low, and we expect these will have a significant impact on port activity and the global supply chain.

As consumer demand continues to grow, container shipping and ports will need to find ways to scale operations and adapt supply chain management. At Spire, we are convinced that data is key to sustainable operations and preventing disruptions. Some ports are already proving this, for example the Port of Rotterdam is leading the way with digitalization.

Look out for our next containership data story, where we will review activity during this same period at other ports around the world, particularly looking for a significant difference in times spent at the port or in anchorage.

You can download a sample of the data we used for this analysis using the form below, and the full containership AIS archive for August to November is now available to purchase in our Spire Data Store. If you would like to know more about our anchorage and port notification feature feel free to book a consultation with our team.

Read also:

With COVID-19 protocols and a busy shipping season, how are cargo ports faring?