Strikes disrupt operations: Leveraging AIS Data to minimize their effects

In a historic labor dispute, dockworkers along the US East Coast and Gulf Coast have launched the first major strike by the International Longshoremen’s Association (ILA) since 1977.

Representing over 45,000 longshoremen, the ILA’s strike temporarily halted about half of the country’s ocean shipping, disrupting the flow of goods from food to automobiles across 36 major ports, including New York, Miami, Baltimore, and Houston.

The recent dockworkers’ strike and its implications

The strike, which lasted for three days, followed a breakdown in negotiations between the ILA and the United States Maritime Alliance (USMX). Central to the dispute were demands for pay increases and resistance to terminal automation projects, which workers fear could threaten jobs. The ILA rejected the employer’s offer for a new six-year contract, citing that it fell short of their demands amid inflation concerns and a surge in profits realized by the shipping companies following the COVID-19 pandemic. The previous contract had expired at midnight on Monday, September 30th.

Although the strike ended after three days, analysts warned that even a short disruption could have significant economic ripple effects, costing the economy billions of dollars. Businesses dependent on ocean shipping and smooth supply chain operations for both exports and vital imports faced delays, with industries from agriculture to automotive at risk. However, the swift resolution helped to mitigate long-term damage.

The strike was suspended after a tentative agreement was reached, which includes a 62% pay raise over six years. While this deal addresses wage concerns, it leaves unresolved the contentious issue of automated machinery at ports, a key point of disagreement between the union and shipping companies. This issue will remain a focal point of negotiations leading up to the next deadline on January 15th.

Monitoring disruptions: how AIS data informs logistics during strikes

Labor strikes, like the recent dockworkers’ strike, underscore the importance of effective monitoring in the logistics industry. Strikes can lead to significant disruptions at ports, causing delays in cargo movements and impacting supply chains. In these situations, AIS data plays a crucial role in helping the logistics industry track the effects of such disruptions. By providing real-time information on the location and status of vessels, AIS data allows companies to monitor port congestion, understand which shipments are affected, and assess the overall impact on supply chains. Spire’s Port Congestion uses best in class AIS and Port Events data to build a congestion index alongside various metrics, allowing to see waiting time at port, port turnaround time, number of vessels in port and ships in anchorage. This information helps logistics managers make informed decisions on rerouting cargo or adjusting schedules to minimize delays, giving them a clearer picture of the operational challenges posed by labor strikes.

To illustrate the impact of the strike, we looked at Spire Maritime AIS data for two major ports: New York and Miami. These ports serve as examples of how shipping patterns shifted in response to the labor disruption.

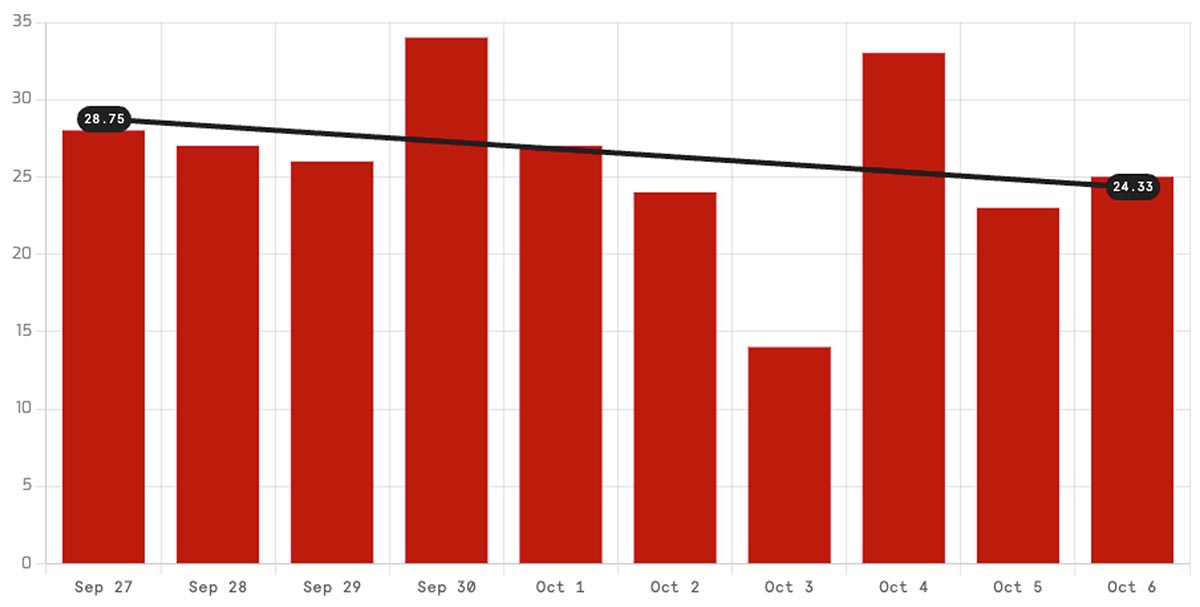

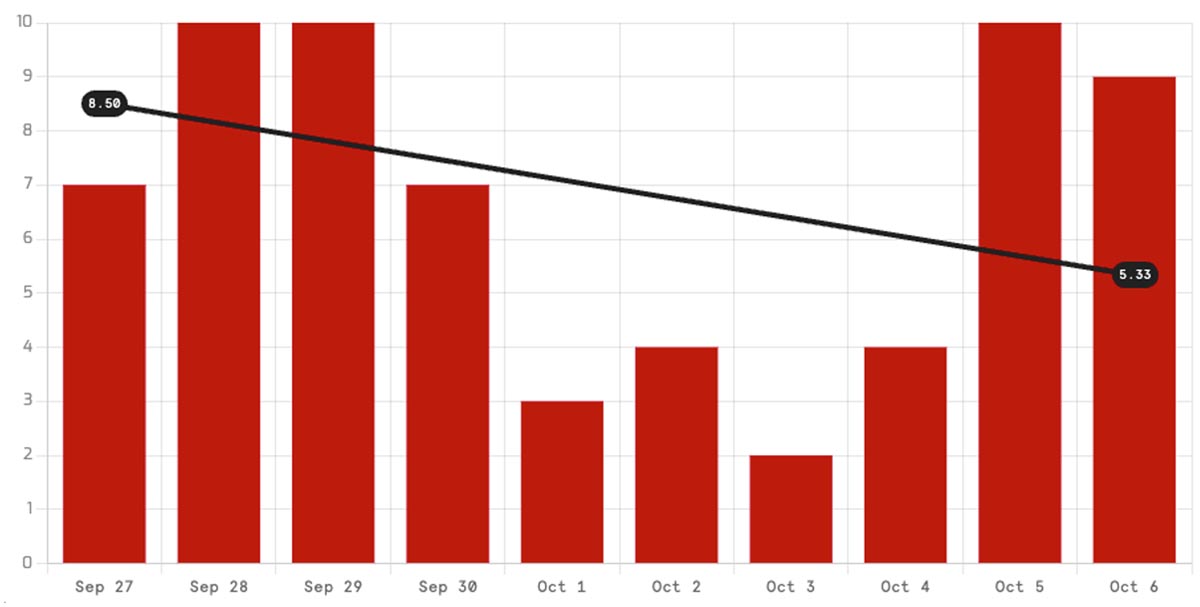

In the day or two leading up to the strike, there was a brief surge in vessel arrivals as companies likely rushed to avoid the impending disruption. However, as expected, port arrivals dropped significantly during the strike itself. While traffic picked up again after the strike ended on October 4th and ports worked to clear the backlog, the overall average number of vessel arrivals during this period remained lower than usual, reflecting the broader impact of the disruption.

New York daily arrival stats

Miami daily arrival stats

During the strike, port capacity reached near-saturation levels, severely impacting operations. With availability plummeting to below 10% across several ports, the situation was particularly dire in New York, where availability dropped to a mere 3%. This limited capacity created bottlenecks, as incoming vessels had nowhere to dock, exacerbating delays and complicating efforts to manage the backlog of cargo. Overall, and particularly in these exceptional circumstances, AIS data proved vital for real-time monitoring, enabling logistics managers to track vessel congestion and assess the strain on port resources.

New York, NY (USNYC)

3% estimated availabilty

164/169 slots occupied

5 slots available

Miami, FL (USMIA)

9% estimated availabilty

74/81 slots occupied

7 slots available

Leveraging AIS data to improve port operations

The strike concluded after the USMX agreed to a total pay increase of $24 per hour over the life of the contract, translating to a significant 62% rise. This wage adjustment necessitates that ports enhance their operational efficiency to absorb the increased labor costs. Utilizing Spire Port Events data can be instrumental in achieving this efficiency. By focusing on key areas such as reducing vessel turnaround times, improving berth occupancy rates, and increasing overall port throughput, ports can streamline operations. Efficient scheduling will further reduce congestion and minimize waiting times for vessels, while also improving port infrastructure and resource allocation. This data enables decision-makers to make informed choices regarding infrastructure planning, resource management, and operational processes, ultimately supporting the ports in adapting to the new economic landscape.

While the current agreement between the ILA and the USMX has alleviated immediate concerns by addressing wage increases, a further strike may still loom in 2025, as it does not resolve the contentious issue of automated machinery at ports, a significant point of disagreement between the union and shipping companies. As both sides prepare for potential future disputes, leveraging Historical AIS data can be invaluable. By analyzing patterns from the recent strike, logistics managers can gain insights into vessel movements, port congestion, and operational bottlenecks. This data-driven approach allows companies to learn from past disruptions and develop more effective strategies to mitigate risks, ensuring they are better prepared for any future labor-related challenges.

Learn more about Spire Maritime’s AIS data sets

Contact us for more information on vessel tracking, port operations, and how to monitor disruptions using our various AIS data solutions, including Satellite AIS, Real-time Satellite AIS, Historical AIS, Port Events, and Port Congestion. Some of these unique data solutions are exclusively available through Spire Maritime.

Written by

Written by