How weather-driven volatility in energy markets creates profit opportunities

- Why weather drives electricity price volatility

- Leveraging weather-driven energy volatility as a strategic business advantage

- The power of AI-driven weather forecasts for renewable energy trading

- Direct-to-asset forecasting: The next frontier in energy trading for industry

- Risk, reward, and reframing volatility

- Space-powered weather intelligence for managing energy price volatility

As renewable energy production surges and electricity production becomes increasingly weather-dependent, forward-thinking businesses are seizing new opportunities to act like energy traders – with the help of AI weather forecasting tools.

Global energy demand surged 2.2% in 2024—nearly double its average pace over the past decade—propelled by record heat, AI-driven data centers, and transportation electrification. But behind that headline lies a quiet revolution: the shift from viewing electricity as a static utility to managing it as a dynamic, tradable commodity.

That shift is being driven by the rapid rise of renewable energy production. In 2024 alone, 700 gigawatts of new renewable capacity were added worldwide, according to a report from the International Energy Agency (IEA). Wind and solar power now generate 17% of electricity in the United States, surpassing coal. And for the first time, low-emission sources like renewables and nuclear generated 40% of global electricity. But this green transformation comes with market volatility.

Weather-driven price swings are reshaping how businesses mitigate costs or maximize profits based upon electricity prices. Those fluctuations aren’t just seen as risks anymore—now they’re opportunities.

Why weather drives electricity price volatility

Traditionally, power generation relied on dispatchable sources—coal, natural gas, nuclear—where utilities adjusted output based on demand forecasts. Weather mattered, but primarily for predicting consumption. Now it dictates production, too.

As renewable energy production climbs past 20% and approaches the 30% threshold of total electricity production, price volatility spikes. Why? Because solar and wind can’t be switched on at will. Batteries can’t yet scale fast enough to store surplus energy. Electricity supply is now at the mercy of the weather. Also, when demand and supply don’t align, prices swing—sometimes dramatically.

For today’s energy market, weather now influences all three variables:

- Demand (heat waves or cold snaps drive consumption)

- Supply from solar (dependent on sun exposure)

- Supply from wind (dependent on wind patterns)

This makes weather one of the most potent market drivers—and one of the most lucrative, if you know how to predict it. The result is an energy economy where anyone with flexible electricity usage can think like an electricity trader.

Leveraging weather-driven energy volatility as a strategic business advantage

Consider Bitcoin miners: their operations devour electricity. But in some markets, electricity prices go negative when there’s too much renewable supply. Miners who can forecast those periods profit by consuming energy when it’s cheapest or even when they’re being paid to take it off the grid.

Tech giants like Google are leading the way in weather-driven energy management. Google leverages energy trading to optimize its data centers, shifting operations to low-cost or negative-price periods, capitalizing on renewable energy volatility. Besides optimizing the processing of data that isn’t time-sensitive, Google also dynamically changes its source of electricity. This strategy not only reduces costs but also aligns with Google’s net-zero goals by 2030, showcasing how businesses profit from energy volatility.

Manufacturers are catching on. If a factory can shift its operations to run during off-peak, low-cost hours, it can slash expenses.

These companies aren’t just reducing costs—they’re strategically responding to market signals like a commodity trader would.

This is especially crucial in regions like Europe and Texas, where renewable penetration is significant and price volatility is frequent. The ability to forecast price movements and respond in real time is emerging as a competitive differentiator.

According to the IEA, renewable energy market volatility strategies are critical as wind and solar surpass coal.

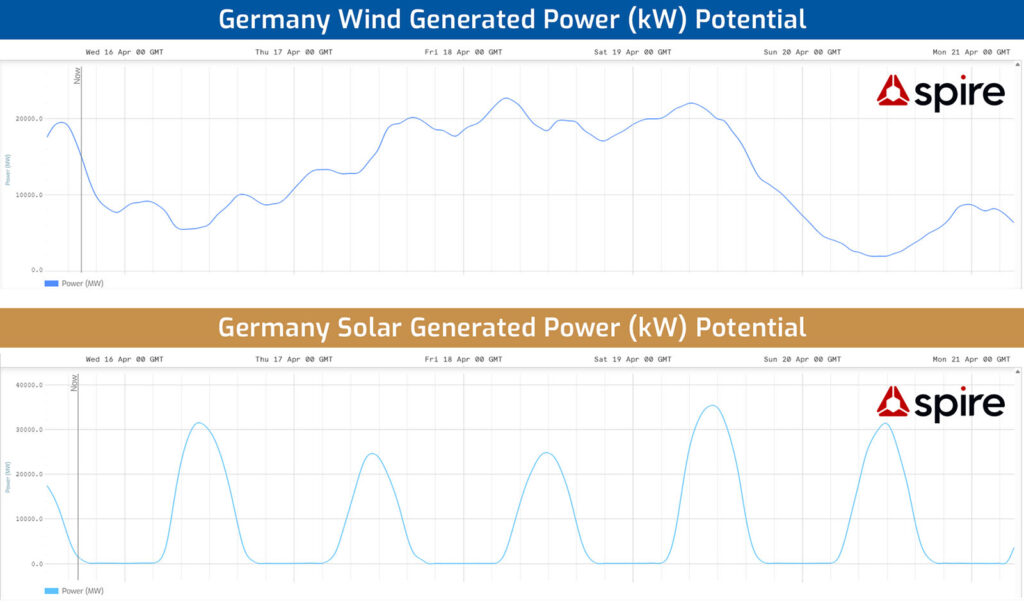

This graphic shows Spire’s AI-powered Power Generation Forecasts for Germany with wind power generation (top) versus solar power generation (bottom).

The power of AI-driven weather forecasts for renewable energy trading

This new paradigm demands more than a five-day forecast. Traditional physics-based weather models were built for deterministic forecasts. But in energy markets, the profit often lies in the tails—those rare, high-impact events. That’s where AI comes in.

AI-powered weather forecasts for renewable energy production enable traders and companies to predict wind and solar output more accurately. Modern AI-driven weather models, like Spire’s ensemble sub-seasonal and weather forecasts (AI-S2S and AI-WX), generate 200 and 30 forecast simulations, respectively, mapping probability distributions rather than single outcomes. Instead of a simplistic “it will be windy,” traders see the likelihood of a range of wind speeds—and the price implications that follow.

For example, a utility forecasting a sudden drop in wind generation can activate reserve power sources in advance, avoiding costly penalties for under-delivery. Commodity traders can hedge against low solar output days or seize short-term buying opportunities during windy periods.

Direct-to-asset forecasting: The next frontier in energy trading for industry

Looking ahead, AI won’t just forecast the weather—it will forecast power.

Instead of a two-step process (weather forecast → generation estimate), AI will be trained to predict energy output at the asset level. A turbine in Oklahoma or a solar farm in California could have a bespoke model trained on hyperlocal data and historical performance.

This direct-to-asset AI modeling improves accuracy, optimizes bidding strategies, and helps energy providers and consumers align production and use more effectively.

Risk, reward, and reframing volatility

Volatility is often framed as a risk. But businesses that can anticipate it and adapt are better positioned to turn it into profit.

A Boston Consulting Group report put it simply: every company needs to think like an energy trader now. Electricity isn’t just a cost—it’s a controllable input.

With AI forecasts and access to probabilistic weather insights, energy-intensive industries can optimize when they operate, where they source power, and how they hedge risk.

And it’s not just tech or manufacturing that stand to reap the rewards. Any organization with significant electricity demand—from retail distribution hubs and water treatment plants to cold storage facilities—can participate. Those who don’t manage this risk are being left behind.

Space-powered weather intelligence for managing energy price volatility

As climate change accelerates, the baselines are shifting. A windier-than-normal season may now be the new normal. Companies focused on compliance; like those disclosing under new SEC climate risk rules; need intelligent, evolving forecasts that reflect changing climatology.

Spire’s satellite-driven weather intelligence helps businesses do just that—from AI-driven 45-day sub-seasonal forecasts and solar and wind power generation forecasts to high-resolution weather forecasts.

Electricity is no longer just a utility, it’s a tradable asset. And in a future defined by volatility, climate change, and competition, the smartest companies will be those that treat weather as a strategic input—and forecasting as a financial edge.

Plan smarter for bigger profits

Learn how to win trades and master weather-driven energy price swings with AI-powered probabilistic forecasts.

Written by

Written by