How Airline dynamics have changed in the US during the pandemic

Interested in this FREE data set?

Spire Aviation data caught the decline and continues to chart the gradual upswing in airline activity worldwide. The pandemic has disrupted the airline world on an unprecedented scale but SURPRISING trends are emerging about shifting dynamics in the airline world!

This data story featuring the US, is the fourth from the four-part Spire Aviation world series. Covid-19 crisis crippled the aviation industry but some airlines have emerged with more resilience than even its larger peers. Spire Aviation data powered by our satellite constellation, focuses on specific geo locations for a deeper, more granular look at this crisis.

The travel lockdown wiped out the demand for global air travel. Even the best of airline pandits couldn’t have imagined the day when a regional Low-Cost Carrier (LCC) in the US, would operate 2X more flights than its legendary long haul airline peers like American, Delta and United Airlines!

The beginning

The first travel restrictions were enforced in China. Spire data reveals the propagation of travel lockdown, which largely began in China at the end of January, and then to the rest of the world as Governments enforced travel restrictions. Chinese airlines cancelled flights from late January (week 4), whereas airlines in the Middle East were still flying close to normalcy until early March (week 9). That’s almost a full month after the lockdown in China.

Rise of a new #1 in the US

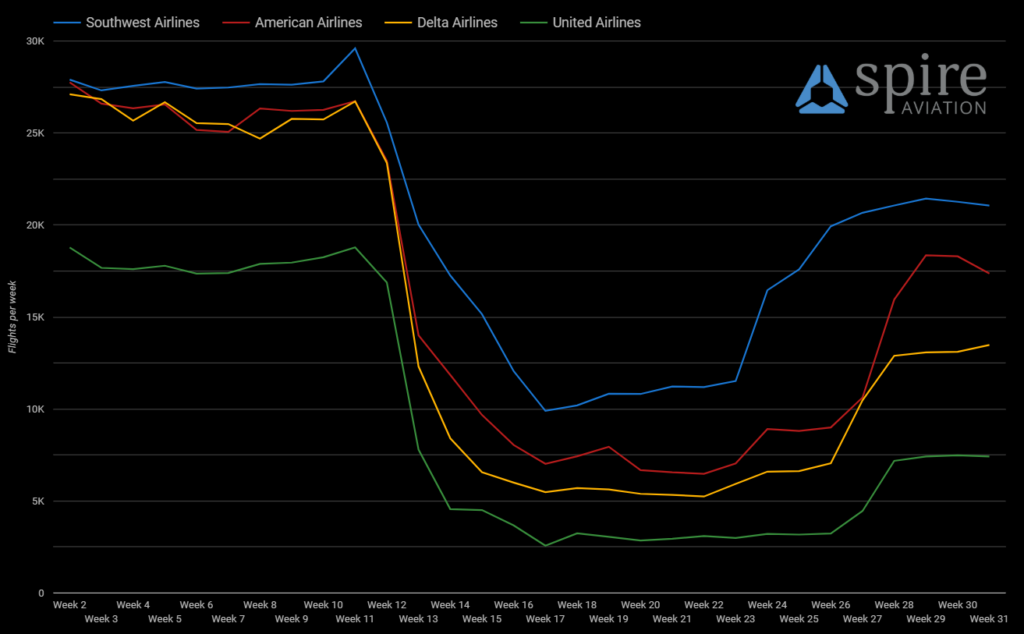

Spire Aviation data showing number of flights per week by the largest airlines in the US (Jan-July 2020)

In the US, home to some of the biggest airlines in the world, saw the number of flights drop to lower than a third of what it was during the beginning of the year. According to Bloomberg, based on the schedules for the week commencing April 13, Southwest Airlines moved up the rankings to become the world’s largest airline with a weekly seat supply of 3 million seats. It surpassed not only its traditional peers like American and Delta, but also the three big Chinese airlines – China Southern, China Eastern and Air China.

Video: The peak – Southwest Airlines air traffic on 11 March 2020 (Week 11)

Spire Aviation data revealed that until early March, airlines in the US were maintaining their flight operations until various states in the US started to enforce travel lockdowns. Week 11 saw peak activity for US carriers when Southwest recorded over 29,600 flights, while American and Delta each had just over 26,700, and United stood at just over 18,700.

Video: The low – Southwest Airlines air traffic on 22 April 2020 (Week 17)

The lowest traffic among these airlines was recorded in late April (week 17). During this week, Southwest recorded almost 9,900 flights, while American was just over 7,000, Delta at almost 5,500 and United at just over 2,500. Late April till mid-May recorded the shockingly lowest number of flights in the US in over a decade.

Video: The rebound – Southwest Airlines air traffic on 22 July 2020 (Week 30)

By early June (week 23), several US states had begun to ease travel restrictions. During the weeks of June, airlines steadily ramped up flights across the US. Within a month, the four major airlines more than doubled their flight activity. By early August (week 31), Southwest was still outpacing its rivals with over 21,000 flights, but now by even bigger margins. American was closest to it with just over 17,300 flights, while Delta had almost 13,500 and United just over 7,400.

Just like in the US, across the Atlantic, there was now a new dominant airline.

Meanwhile in Europe

During the first peak Covid wave, Europe and the Middle East had seen the biggest fall in the number of flights across the globe. Major European airlines had grounded the majority of their fleet during this period. Only one European operator saw this as an opportunity to aggressively ramp up operations. Wizz Air was fast to put flights back into operation, navigating travel restrictions placed erratically by various countries in the EU and among other eastern European countries. Hungary’s Wizz Air jumped up to the top 10 airlines in the world by scheduled seat supply during the weeks from Week 13.

Spire Aviation data caught the decline and continues to chart the gradual upswing in airline activity worldwide. The pandemic has disrupted the airline world on an unprecedented scale but surprising trends are emerging about shifting dynamics in the airline world.

Which airlines do you think will come out of this stronger? Let us know.