How Amazon Air’s rapid growth threatens competition with FedEx and UPS

Interested in this FREE data set?

Amazon Air is still a newcomer to the air cargo space, but Spire’s aviation data shows how they have rapidly grown their operations over the last year. And other strategic decisions, such as transporting third party goods, suggests there is potential for it to compete with FedEx and UPS in future.

Amazon Air, whilst still a newcomer to air cargo, is making moves to compete with market leaders FedEx and UPS. Not only is the airline growing rapidly in the number of aircraft operated and airports served, the company is now transporting goods for third parties, putting it head-to-head with its competitors.

Amazon Air has seen rapid growth in the last year

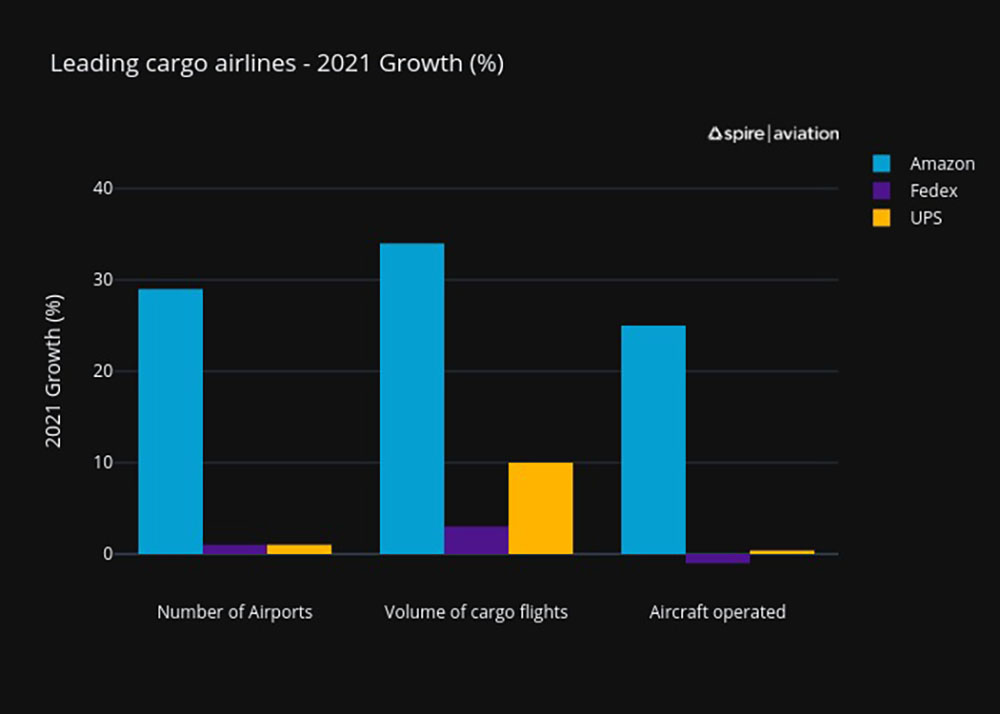

In 2021, Amazon Air took advantage of the increased demand for ecommerce during COVID-19, growing 35% in terms of cargo flights – a greater rate than FedEx and UPS. It also increased the number of airports served by 30%, and the amount of aircraft operated by 25% compared to the start of the year.

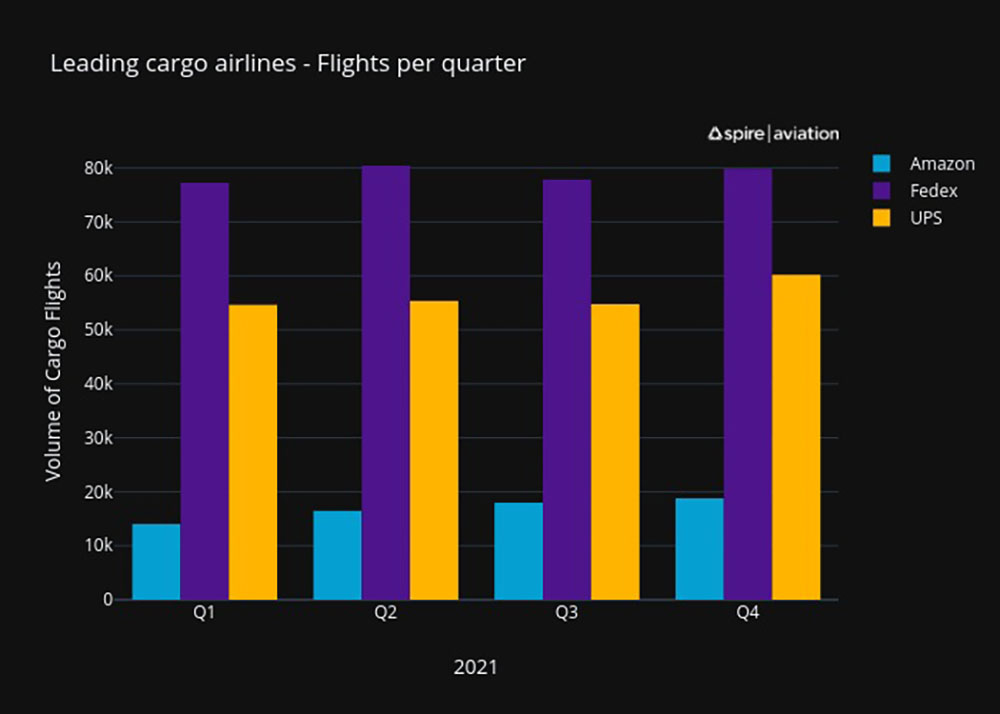

Of course, FedEx and UPS still dominate in absolute numbers. FedEx operates more than 1000 aircraft per quarter (of which they own 473) and UPS more than 800 (of which they own 289). Amazon Air, however, currently relies on wet leasing capacity, operating a much smaller, but growing, number of aircraft. This difference in fleet size is also reflected in the volume of flights.

However, Amazon expanded their fleet in 2021 by buying a number of second-hand Boeing 767s, and plan to increase the number of planes they operate through a mix of owned and leased aircraft. They are also considering adding used Boeing 777 ERs to their mix, which have more cargo capacity.

Amazon Air focuses on US and European markets

Amazon Air’s growth strategy also differs from FedEx and UPS. Whilst the two incumbent airlines fly hub-to-hub across the globe, taking in Asia, South America and Australia, Amazon has focused its activity on the US and Europe – its core markets.

FedEx Cargo Operations in 2021 – airportss

UPS Cargo Operations in 2021 – airports

Amazon Cargo Operations in 2021 – airports

Within these two regions, Amazon Air has been rapidly expanding the number of airports it serves. At the beginning of 2021, Amazon served just under 150 airports and finished the year with close to 200, including 10 in Europe. It now flies to 48 cities in the US and has invested around $1.5bn into its first hub at Cincinnati/Northern Kentucky International Airport.

Direct competition with FedEx and UPS on the horizon

Until last year, Amazon Air had been servicing only Amazon goods. However, a strategic move at the end of Q3 2021 saw Amazon Air begin to move goods for third parties. This puts it head-to-head with FedEx and UPS. And their interest in purchasing 777s suggests Amazon Air intends to directly import goods from China, further intensifying that competition.

This, combined with the growth of the fleet, the increasing number of airports, and the investment in a US hub, makes it clear that Amazon Air plans to expand further. And whilst their route maps look very different to those of FedEx and UPS today, they could look more similar in the coming years.