COP 27: Turning the tide on climate change drives business value

Here’s a question: is what’s good for the planet also good business?

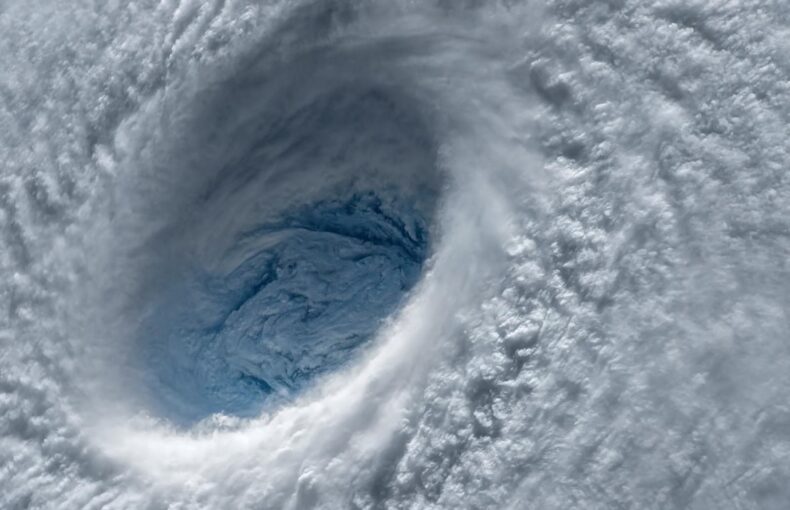

Climate change induced disasters have caused $1.5 trillion in economic losses over the past five years.

The money for mitigation (technologies such as solar and wind farms that prevent emissions), adaptation (making infrastructure resilient to the effects of warming) and now loss and damage all comes from the same group of rich donor nations. The funding pool rarely grows as fast as the economies that contribute the most to climate change. This is especially surprising given that the US, the world’s second largest carbon emitter, alone has faced disaster costs of $788.4 billion in the last five years, more than half of the global cost and one-third of the disaster cost total of the last 43-years (1980-2022), which exceeds $2.295 trillion (inflation-adjusted to 2022 dollars).

The costs of dealing with flooding, heatwaves and drought are rising at a pace determined by the warming climate itself. The money that’s spent repairing the effects of a disordered atmosphere risks cannibalizing the funds that could be spent to prevent its cause.

The value of data in the fight against climate change

Climate change – and the response of governments at home and abroad to it – will affect businesses financially, both over shorter horizons and the longer term. Since it influences key economic variables such as output and inflation, climate change matters.

This means that climate change is everybody’s business. While government delegates from around the world meet at COP27 to deliberate on how the world can slow climate change, the private sector has a role to play too. The need for new ideas has never been higher. Old formulas need to be rethought.

Developing a culture of innovation at the governmental and business level is required. By recognizing that managing the impact of climate change and its financial costs is a shared responsibility, countries and businesses can come together to present unified solutions based on innovative thought and data-sharing.

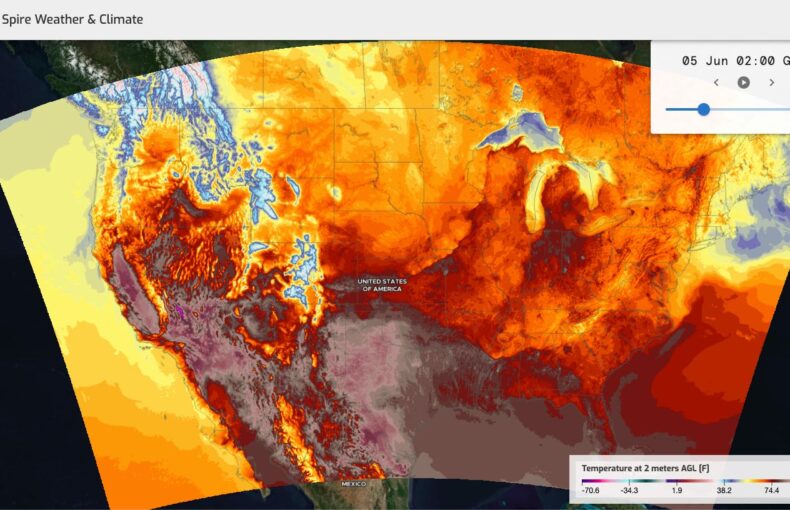

Making wise, data-driven, and scientifically sound decisions is the only viable course. It will depend on collecting granular data on a global scale to build an information matrix that can be plugged into computer-aided analysis, machine learning, and artificial intelligence solutions. This is where companies such as Spire, come into the picture to cater to this urgent, growing need for global, accurate data. Such processes will bring a myriad of practical and theoretical methodologies that can alleviate the climate change impacts that cannot be avoided while concurrently dialing back dire risks that are now in the realm of the possible. This may sound difficult, but there are tech companies dedicated to the collection and dissemination of weather data.

Download our free white paper and learn what the role of weather data is in fighting climate change

Studies show fiscal gain in sustainable business practices

To incentivize private companies’ governments and specialist companies to work more collaboratively together in this arena, especially for nations that don’t have the capacity, governments can formulate economic policies to set up offices so as to kickstart the economy, provide more jobs etc and build their financial position.

The private sector also needs to be more serious about climate change and its impact on business. The pursuit of short-term gains tends to make the people at the top disregard the danger.

A recent study by Ernst & Young New challenges earlier arguments that there is a trade-off between financial and non-financial impacts of climate change investments. As per the study, comprehensive transformational approaches to sustainability return more value — financial, customer, employee, societal and planetary — than companies anticipate.

As per the EY study, companies that take decisive climate action do not just create more value for the planet, they also capture more financial value for themselves on measures such as revenue growth and earnings. Referred to as value-led sustainability, 69% of respondents reported that they capture higher financial value than expected from their climate initiatives.

This challenges the perception that there is a trade-off between financial and nonfinancial impact. To the contrary, for a subset of “pacesetter” companies taking the boldest steps, comprehensive climate action helped boost customer value (such as brand perception and purchasing behavior) as well as employee value (such as staff recruitment and retention), which in turn led to improved financial value. These pacesetters are 2.4 times more likely than companies taking few climate actions (observers) to report significantly higher-than-expected financial value as a result of their climate initiatives. They’ve also achieved higher emissions reductions to-date.

By putting climate action at the heart of business strategy, value is delivered across a range of vital measures. The sooner companies get started, the more they learn and the more value they receive.

Written by

Written by