Reimagining disruption & tapping into opportunities using air traffic data

Whatever industry you work in, the events since the pandemic have disrupted every data model and business operation as we knew it.

Air traffic data provides valuable insights connecting the impact of aviation across the world economy through trade, travel, logistics, and commerce. With flying no longer being a luxury but a part of day-to-day life, this data has become ever more important, extending its application far beyond the world of airports.

Find out how you could benefit from air traffic data

Today, flight tracking data is used across the board – from flight operations, geospatial intel, border management, applications development, financial analysis, travel analytics, tourism, and more. It helps drive innovation and address some of the biggest challenges facing the aviation industry, from adapting to a post-Covid-19 world to improving safety, sustainability, and efficiency. And since it’s still relatively untapped, companies that choose to leverage this data have a secret weapon in their arsenal.

Air Traffic Then and Now

The Wright brothers may have first flown planes as early as 1903 but the aviation industry really only took off in the years following the First World War. In 1920, air traffic control was introduced for commercial flights at London’s air terminal in Croydon. Using a system that looks very rudimentary by today’s standards, the controller would give the pilot a red or green light for take-off and acknowledge position reports sent by radio. Safety was becoming a growing concern in the US too, following a number of mid-flight collisions and in 1935, the first air control centre was established in Newark, New Jersey. We’ve come a long way since, with millions of passengers being safely transported day to day.

Thanks to today’s air traffic control services, airlines and airports are able to operate with greater efficiency. They’re able to make the most of capacity while maintaining safety standards and reducing fuel consumption to drive down operating costs and environmental impact.

Versatility of Air Traffic data

Air traffic data goes far beyond air traffic management. Here’s how – our partners are now able to capture and process more data at speed, using machine learning, AI, and predictive modeling, opening up new avenues for data usage in both the commercial and non-commercial worlds. It’s now possible to crunch petabytes of data in near real-time and use the analytics to inform decision-making and gain a competitive advantage.

Image: Showing how Satavia used Spire Aviation Data to predict imported daily infections from key destinations with quarantine exemptions in England in 2020

Air traffic data enables air freight companies to plan more efficient logistics operations, while aircraft operators are able to more accurately predict and schedule maintenance work. Not just that, our flight tracking data also drives:

- Product innovation: Flight tracking data becomes a key ingredient that reveals actionable insights enabling new product features and development.

- Cost efficiency: Reducing data costs, including moving data from on-premise servers to the cloud, as well as sector-specific cost savings such as an airline optimising its crew schedules.

- Decision-making: Valuable analytics provide deep insights that inform decisions and address challenges in commerce, travel, logistics, aviation and so on.

The aviation industry uses data science to make sense of vast amounts of data and automate, streamline, and optimize operations such as crew management, communication, fuel consumption and much more. The application of predictive analytics is also critical for air safety, with airline operators combining data from sources such as air traffic controllers’ and pilots’ reports, as well as the aircraft themselves to detect patterns and potential safety concerns.

OEMs (Original Equipment Manufacturers) are kitting out aircraft with more sensors to capture more data than ever, while cloud-based platforms like Spire’s allow operators to pull multiple data sources into a single secure environment. It’s now possible for on-board maintenance systems to detect a fault and automatically schedule an engineer and order parts, increasing safety and minimising flight disruption. And this is all thanks to aviation data and the means to analyse it fast.

The Fourth Dimension: Data From Space

Adding to this rich pool of information is our own data, captured on the ground and by our constellation of more than 30+ nanosatellites operating in low-Earth orbit. Our satellites capture global aircraft movements from space using ADS-B signals, even when the aircraft is flying over oceans, deserts, mountains, and most regions where there is no ground-based tracking available. From this we can generate versatile datasets – by mapping aircraft position and status along with aircraft type and airline data, flight and airport Information, gate and terminal information – delivered using our real-time and historical data APIs.

Terrestrial data is unable to provide coverage when it comes to aircraft flying over oceans, seas and remote areas. This is where satellite data comes in – no matter how remote the area is – this provides a greater level of detail and tracking which can be utilized by ASPs, OEMs, consultants and more for unmatched situational awareness. Moreover, if the satellites are small and nimble LEMURs like ours, the price-point is friendly as well.

Helping the Travel and Tourism Industry to Fly High

Covid-19 is reported to have cost travel and tourism $ 935billion in the first ten months of 2020 alone. As you read this, the situation is far from certain, and many are pinning their hopes on a successful vaccine roll-out and pent-up consumer demand to fuel the recovery. When that will happen is not yet clear, but from the start of the pandemic, flight tracking data has helped us to understand changes in capacity and demand – allowing the travel industry to shape its strategies accordingly.

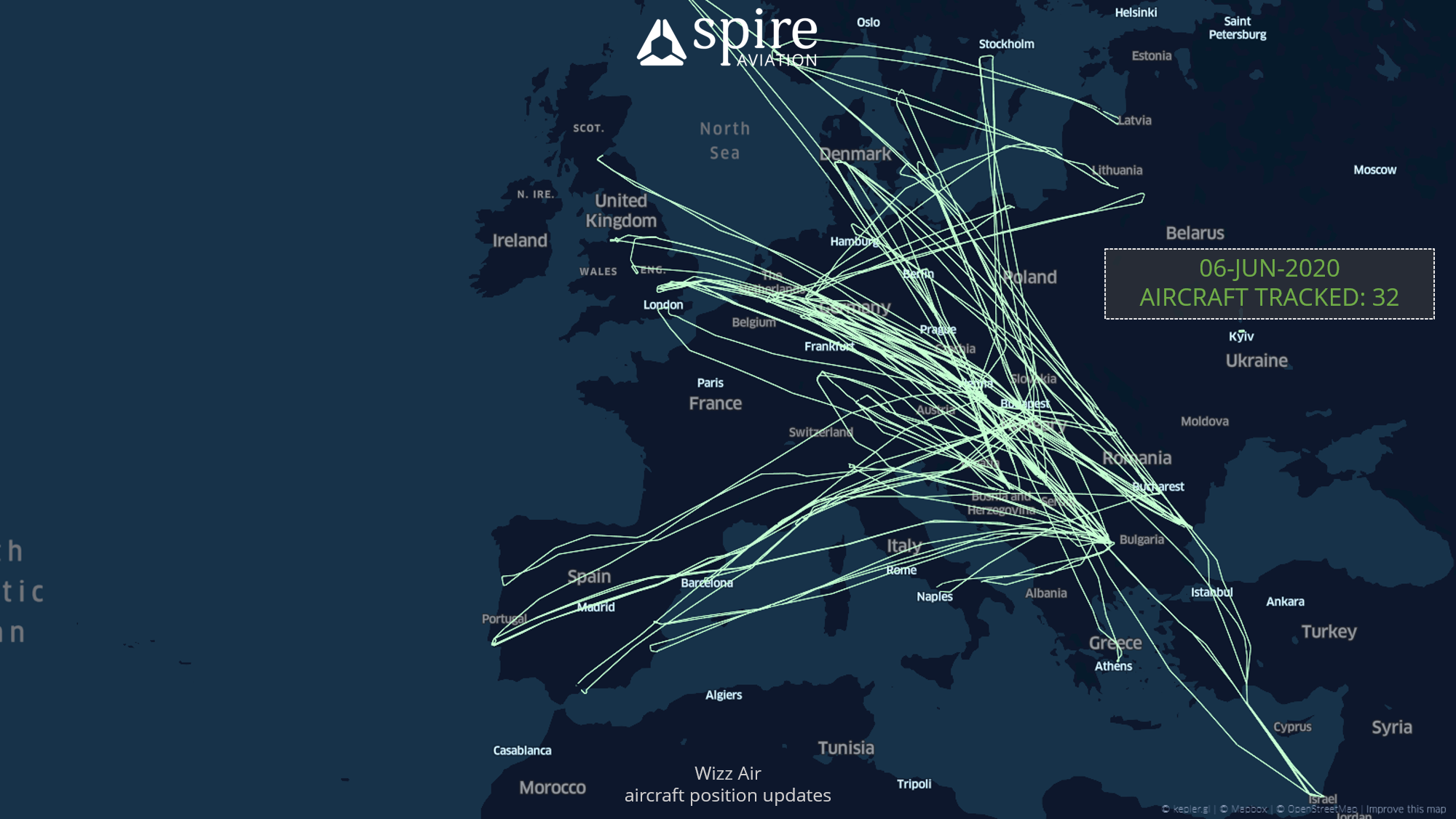

Use the image above with the slider to discover the flights operated by Wizz Air on the first Saturday of May and June. The number of aircraft operated by Wizz Air is estimated to have doubled between the same dates, from 16 on May 2nd to 32 on June 6th.

Even by doing something as simple as capturing flight patterns using satellite and terrestrial data for a single airline- as we did with Wizz Air last summer – we gain a deeper and more granular view of passenger trends and are therefore able to spot signs of shifting travel patterns. Sure enough, we discovered that in the midst of a pandemic, the number of Wizz Air flights jumped from 16 on May 2nd, 2020 to 32 on June 6th. As countries emerge from lockdowns at different speeds, and entry requirements change, travel operators and the hospitality industry will need to keep a close eye on flight activities to determine their investment and operational strategy across regions.

Supporting Regulators, OEMs and MROs

Having undergone the required changes, following two fatal crashes, the Boeing 737 Max was cleared to fly in late 2020 but its return has been staggered to demonstrate its safety.

March 10-16, 2020: The week when MAX was grounded:

Spire data reveals a clear timeline, as the groundings were enforced one after the other by countries around the world (visual left). Following the Ethiopian crash on March 10, regulators started grounding the MAX. Within a week, the daily MAX flights dropped from 1,400 to zero. There were a little over 300 MAX aircraft flying worldwide up until the crash.

Using our air traffic data, we tracked the 737 Max’s first training and passenger flights and highlighted its return-to-service across different countries, enabling airlines to anticipate, prepare, and manage fleet capacity more effectively. OEMs and MROs (maintenance, repair and operation) can also analyze routes flown by their aircraft, and predict what the maintenance requirements are by tracking individual aircraft usage and flight patterns.

Air traffic data: Meeting soaring demand for cargo and logistics services

With the appetite for air cargo services growing, freight operators are looking for new and innovative ways to increase capacity in the supply chain. The world’s largest cargo plane, the Antonov AN-225 Mriya, has become operational again and has been helping to meet some of this demand, particularly during the pandemic when it delivered a record-breaking eight million masks (more than 1,000cbm of cargo) to France.

But the real ‘workhorse’ of the industry is still the B747F, prized by airlines for its lifting capacity, four engines and ability to transport long items. Our flight statistics for air cargo showed that cargo flights soared well above passenger flights and ended the year higher than pre-Covid-19 levels. As well as measuring cargo flight activity, we’re able to identify major logistics hubs and drill down to the type of aircraft used – so operators can understand and utilise capacity effectively in line with demand. It is then no surprise to learn that the top 10 Boeing 747F operators in the world, are also some of the largest cargo airlines of 2020.

Air traffic data helps airline network and fleet strategy

Covid-19 has completely turned business models around, forcing airlines to adapt to enormous and unexpected shifts in consumer demand. Large-capacity aircraft, which once benefited from economies of scale, are all but impossible to fill in the current climate and they’re expensive to maintain, too. Moreover, questions remain about whether their environmental impact will make them unusable in the future. It is clearly evident that even the biggest airlines in the world are grounding the larger A380s and B747s most of them permanently.

Top 10 B747F airlines by flights (2020):

Atlas Air, UPS, Cargolux are among the largest operators of the B747F Fleet. Cargo operators such as Silk Way Airlines, Atlas Air, Air Bridge Cargo and Cargolux have become the stars of logistical efforts to support first responders around the world. And they’re all flying the Boeing 747F.

Mapping flights during the first wave of the pandemic meant airlines could see how devastating it had been on their industry but a few players used this to their advantage – for instance, SouthWest Airlines was thereafter able to to pre-empt the short-lived recovery and ramp up its operations. The move paid off and it went on to take its place among the world’s top 10 airlines by number of seats offered.

Air Traffic Data: At the Forefront of Tech Innovation

The appetite for data – particularly with flight tracking – within the aviation industry has paved the way for an explosion of tech start-ups (or application service providers – ASPs) developing innovative solutions to help companies leverage its value.

One of these is myairops, which uses aviation data to develop a cloud-based solution to help organizations manage complex challenges in different sectors such as crew management, maintenance and more. Here’s a quick look at how they do it.

Last, but certainly not least, data analytics and AI specialist SATAVIA is using its expertise to drive up sustainability across the aviation industry. Combining artificial intelligence, data science, and aerospace engineering, the Cambridge-based tech firm embeds our global aircraft movement data (ADS-B data) feed in its cloud-based decision-making platform, DECISIONX, and enriches it with weather and maintenance datasets to help operators manage their assets more efficiently.

Conclusion

Whatever industry you work in, the events since the pandemic have disrupted every data model and business operation as we knew it. When the Covid-19 crisis began to escalate at the start of last year, our flight tracking data immediately showed the rippling effect of enforced travel restrictions starting in China in late January. Later, as lockdowns began to ease, we were able to demonstrate not just that the aviation industry was recovering but which areas were proving to be most resilient.

With evermore powerful satellites and processing capabilities, companies can map historic trends and deliver data analytics, giving them a strong competitive advantage. What’s changing is the availability of air traffic data; we’re now able to capture and process more of it, rapidly and cost-effectively, so it delivers faster returns in the real world. Since the data is also available via easy to integrate APIs, the time burden on in-house technical teams is minimal. Developers simply plug flight tracking realtime and historical APIs into existing systems and workflows, enabling end-users to quickly and easily access the analytics on the platform they use.

The aviation industry is at a critical juncture, and the road to recovery after the pandemic could be long and painful. On top of that, there are plenty more long-standing challenges to contend with too, from mitigating the impact of climate change to responding to shifts in consumer habits. AI and data analytics are central to the new model, allowing organizations to spot disruption sooner, accurately gauge its impact, and make intelligent decisions.

We’ve barely scratched the surface of how air traffic data has gone from a means of managing airspace and preventing collisions to creating valuable datasets that reduce operational risk, drive up efficiency, and support business growth.

Written by

Written by